Preface

Background and objectives

This case study is a part of a compendium of ongoing research by the Partnership on AI (PAI) investigating the impact of artificial intelligence (AI) technologies in the workplace. The objective is to illustrate the tradeoffs and challenges associated with the introduction of AI technologies into business processes. Through this series of case studies, we intend to document the different types of AI techniques implemented, as well as discuss the real-world impacts of AI on labor, the economy, and society broadly. Researchers often struggle to understand the economic and social consequences of AI and its wide-ranging implications for society. For instance, contemporary economists grapple with the question of why ongoing AI and broader digitization efforts have not yet produced clearly measurable productivity gains for the global economy.1 At the same time, one major question for the public and policymakers has been AI’s impact on the workforce, both in the changing nature of work and net job loss or creation. Our hope is to help ground the conversations around productivity and workforce impact in examples of real-world AI implementation while highlighting nuances across sectors, geographies, and type of AI techniques used. This case study specifically looks at how an incumbent steel manufacturer facing significant industry headwinds launched an internally developed AI strategy to optimize its production processes with ML models.

Methodology

Subject organizations were recruited from a pool of 100+ candidates that ‘AI, Labor, and the Economy’ Working Group members submitted to the case study project team. The final set of organizations prioritized for study reflects a combination of their willingness to participate in the project and the intention to profile organizations varying in size, geography and industry sector. The following case study was developed over the course of four months in the summer and fall of 2018. The methodology included interviews with different stakeholders at Tata Steel Europe (TSE) who are directly or indirectly involved in their Advanced Analytics Program – an attempt to bring AI use cases into the operations of its IJmuiden steel plant in IJmuiden, Netherlands. The interview subjects included executive sponsors, plant managers, project managers, and data scientists. Interviews did not include plant operators (a more implementation-focused role), production crews, or customers. As a result, the case study primarily reflects managerial perspectives.

Representatives from non-profit and for-profit organizations affiliated with the Partnership on AI’s Working Group on “AI, Labor, and the Economy” supported the case study development by conducting interviews, drafting write-ups, and supplementing the case with external research or expert consultations on the industry or macroeconomic dynamics.

Definition of terms

While we acknowledge that there is no consensus on the definition of terms such as AI and automation, we would like to explain how these terms are used in the compendium:

Artificial intelligence/AI is a notoriously nebulous term. Following the Stanford 100 Year Study on Artificial Intelligence, we embrace a broad and evolving definition of AI. As Nils J. Nilsson has articulated, artificial intelligence is that activity devoted to making machines intelligent, and intelligence is that quality that enables an entity to function appropriately and with foresight in its environment. (Nils J. Nilsson, The Quest for Artificial Intelligence: A History of Ideas and Achievements, (Cambridge, UK: Cambridge University Press, 2010).

Our definition of automation is based on the classic human factors engineering definition put forward by Parasuraman, Sheridan, and Wickens in 2000: https://ieeexplore.ieee.org/document/844354, in which automation refers to the full or partial replacement of a function previously carried out by a human operator.2 Following Parasuraman et al.’s definition, levels of automation also exist on a spectrum, ranging from simple automation requiring manual input to a high level of automation requiring little to no human intervention in the context of a defined activity.

Explainable AI or Explainability is an emerging area of interest in communities ranging from DARPA to criminal justice advocates. Broadly, the terms refer to a system that has not been “black-boxed,” but rather produces outputs that are interpretable, legible, transparent, or otherwise explainable to some set of stakeholders.

In this compendium, a model refers to a simplified representation of formalized relations between economic, engineering, manufacturing, social, or other types of situations and natural phenomena, simulated with the help of a computer system.

Advanced Analytics at Tata Steel Europe

Within Tata Steel Europe, the AI-related initiatives and strategy are referred to as the Advanced Analytics Program (also called Advanced Analytics or AA). Tata Steel Europe considers AA to be a shift from traditional data analytics. It is defined by a number of technical attributes: a significant increase in variables used in the analytics; the use of both structured and unstructured data (e.g., sensor data vs. images, audio); more predictive (vs. descriptive) analytics; and the use of more basic techniques ranging from linear regression and decision trees to more advanced techniques including random forests and some testing of neural networks, which perform more complex optimization and prediction tasks.

1. Introduction

Tata Steel Europe, a leading steel manufacturer with operations throughout the continent, faced industry challenges, volatile earnings, and increasing customer demand for higher-quality products. The management team was thus exploring ways for the company to find sustainable long-term profits, while also looking to build the foundation for the company’s future through a digitization effort and a shift to more agile ways of working.

Inspired by the increase of artificial intelligence in manufacturing generally, the leadership of Tata Steel Europe explored whether they could transform their largest integrated steel plant, in IJmuiden, Netherlands, into a leading model for manufacturing analytics and boost the plant’s performance. The leaders recognized, however, that this change would not come without trade-offs, and that successful implementation would be challenging.

1.1. Background on Tata Steel Europe

TSE is a wholly owned subsidiary of Tata Steel Limited, a company incorporated in India with shares listed on the Bombay Stock Exchange, and itself a subsidiary of the Indian conglomerate Tata Group. TSE was formerly known as the Corus Group, which was a merger between British Steel and Koninklijke Hoogovens. It was acquired by Tata Steel Limited in 2007.

Tata Steel Europe is the second-largest steel producer in Europe, with a focus on steel products for the automotive, packaging, and construction sectors.3 Its main production assets are located in the Netherlands and the United Kingdom.

This case study focuses on Tata Steel Europe’s largest plant, in IJmuiden, Netherlands, where the Advanced Analytics Program was launched. IJmuiden is a small port city in the province of North Holland with a population of roughly 30,000.

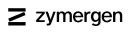

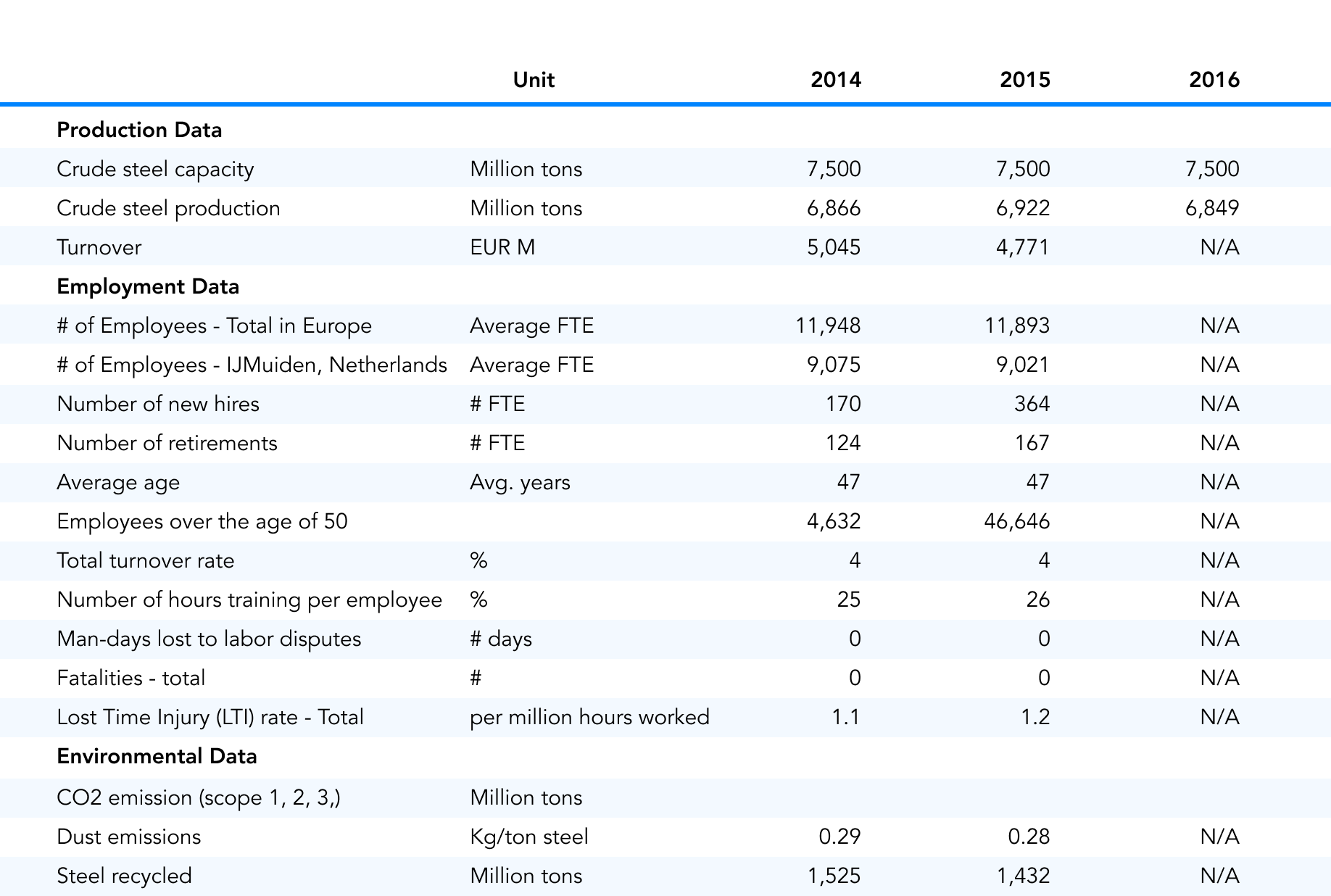

The IJmuiden plant is a fully-integrated steel plant covering the full steel production process. The plant employs about 9,000 full-time equivalents (FTEs4) (See Exhibit 1) and produces about seven million tons of steel products annually. An estimated 35 to 40 percent of the plant’s workforce is unionized, with many workers a part of the plant’s production crew.

Breakdown of the workforce at the IJmuiden plant

In FY15/16, the average age of an employee at Tata Steel Europe was 47 years, and 53 percent of the workforce was over the age of 50.5 Most of the production crew employees have a high school degree or equivalent and have been with the company for a relatively long time period (e.g., 10-25 years). While a production crew job does not require university training, the plant also employs workers such as process engineers, which may require a university degree or above. Some employees also have a Ph.D. in a technical field, such as physics. (For more information, see Exhibit 2 in Appendix 7.2).

1.2. Background on the steel industry

The global steel industry has undergone tremendous changes in the past several decades. Today, global steel supply exceeds demand, with a surplus of 540 million metric tons in 2017, the second-highest in history.6 The downward pressure on steel prices of this oversupply is just one of the challenges facing the industry, where even small price reductions can have significant impacts on a company’s profit margins and threaten viability. Raw materials prices have also been volatile in recent years, exposing steelmakers to risks from input costs that they often cannot control. In addition, industry-wide factors, such as unionization and government regulation, may affect employers’ workforce flexibility or other managerial decisions during times of challenging industry dynamics.

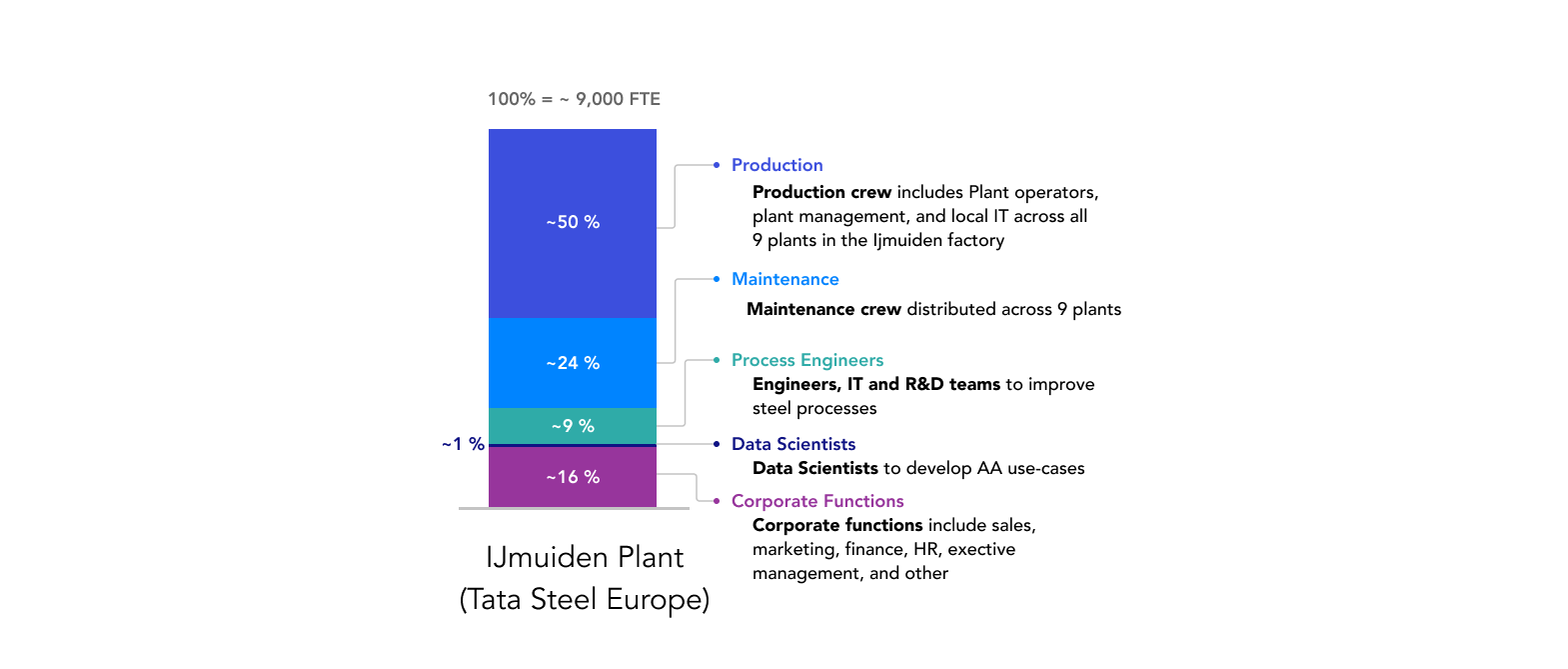

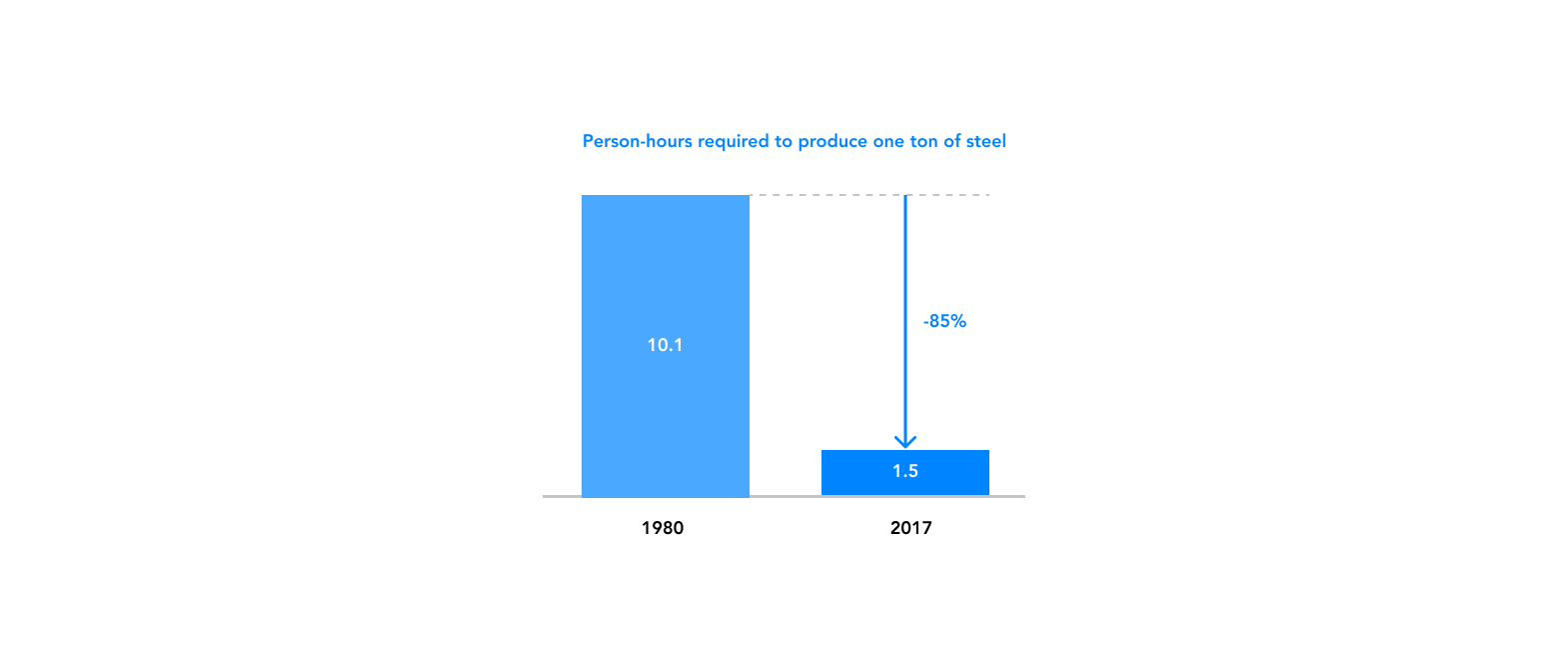

In the past several decades, steel worker productivity has increased significantly, and employment in the steel industry has fallen. Twenty-five years ago, the TSE plant in this case study produced three million tons of steel annually with 23,000 FTEs. Today, it produces seven million tons of steel with only 9,000 FTEs7. The industry trends globally and in the U.S. are similar: The U.S. steel industry alone shed about 80 percent of its workforce between 1962 and 2005, or about 400,000 employees. Similarly, global employment in the steel industry fell 39 percent from 1974 to 1988 and another 9 percent from 1990 to 2012.8 Meanwhile, worker productivity globally has greatly increased due to new technologies, associated improvements in resource allocation, and increased competition.9 One study from the U.S. estimates that the person-hours required to produce one ton of steel declined 85 percent from 1980 to 2017 due to automation technology (See Exhibit 3). While employment in the steel industry fell by a factor of five, shipments of steel products in 2005 was roughly at the level of the early 1960s. Thus, output per worker grew by a factor of five in the same timeframe.10 (For more on productivity increases, steel output, and employment, see Exhibits 3 and 4. See additional macro-economic Exhibits 5 and 6 in Appendix – 7.3 and 7.4).

The labor required to produce the same amount of steel has significantly declined due to automation

Labor protection laws and workforce participation in labor unions can influence employers’ decisions about workforce reductions in light of these industry dynamics. The Netherlands in particular has a relatively low level of labor market flexibility,11 according to a study that looked at measures of redundancy rules and costs for EU and OECD countries12. On the other hand, the percent of total employees organized in unions in the Netherlands has declined steadily in recent years, down from 26 percent in 1995 to 18 percent in 2011, and the Netherlands has a lower rate of unionization than other EU countries.13 At TSE’s IJmuiden plant, an estimated 35 to 40 percent of workers — largely members of the production crew — are unionized.

US primary metals industry - output and employment, 1990 - 2018

2. Business context prior to Advanced Analytics (AA)

2.1. Business challenges facing TSE

Tata Steel Europe’s management faced three key challenges, which contributed to its decision to explore analytics and AI. These challenges were primarily driven by global and European steel industry trends, as well as by TSE-specific customer and labor dynamics:

1. Constant pressure to improve margins in a capital-intensive and competitive industry

Due to the oversupply in the steel industry, steel manufacturers are constantly forced to improve processes and identify cost savings to increase profit margins that can be quite volatile. The TSE executive who oversees the Advanced Analytics program noted, “We are in stiff competition with many players. If you don’t improve or innovate, you will be at the bottom.” Because of the level of competition, even small improvements can have an outsized impact. A few percentage point improvements in yield can have a substantial impact on EBITDA14 (a common proxy for cash flow) — and improving EBITDA is critical for funding capital-intensive projects that allow the company to continue operating, such as investing in new equipment or maintaining old assets.

Raw materials (mainly iron ore and coke, a high-carbon fuel) are the major components of TSE’s cost base: A TSE technical director estimates that these materials consume about 63 percent of the IJmuiden plant’s revenues. Labor costs are the second-largest cost driver for TSE. As one TSE executive put it, “It’s a very harsh business in steel: very high revenues [but] with very thin margins. We are affected by a variety of forces — inflation, wages, raw materials costs. It means that we have to continuously improve.”

2. Customer demand for higher-quality products

Steel is commonly perceived as a commodity product (one in which many companies’ products would be considered identical substitutes for one another), yet there is significant customer demand for high-quality steel products that meet regulatory or other industry-specific product requirements. The IJmuiden plant alone produces about 200 different steel products, with up to 50,000 different specifications (stemming from different quality and regulatory requirements) for customers in sectors such as automotive, construction, and packaging. For example, an automotive customer can use 20 to 30 different steel products in a car. Higher-quality products often require higher-quality raw materials. Because of these dynamics, steelmakers across the globe compete for the highest-quality iron ore and coke, which increases raw materials costs.

3. Aging workforce and potentially lower supply of future steel plant labor

The production workforce at Tata Steel is aging: A large portion of plant operators will reach retirement age in the next 5 to 15 years, which will lead to an increased workforce attrition rate15. When operators retire, they take with them years of valuable experience, which cannot immediately be replaced by hiring new plant operators. There are a number of reasons that it may not be easy to replace the soon-to-retire plant operators:

- Cost considerations: In the Netherlands, the unemployment rate has been on a steady decline since 2014 and is currently below 4 percent. Conversely, wage growth has been on a steady increase.16 Such cost factors, combined with the fact that it will take years for a new operator to gain the experience and thus skills necessary to fully replace a retiring operator, is incentivizing TSE to look at technological solutions, such as its AA program.

- Job preferences: Finding labor for steel production is challenging in the Netherlands. Over time, steel plant jobs have also become seen as less desirable, due to the working conditions and inconvenient working hours (e.g., night shifts).17

2.2. Context prior to Advanced Analytics (AA) implementation

Tata Steel Europe has faced volatility in its profitability over the past decade due to increasing competition in the global and European steel industry. To address this, the management team launched a program called the “Sustainable Profit Program” in 2014 to identify long-term sources of stable profit.

Although automation has been a major driver of continuous improvement in steel manufacturing processes over the past decades, the potential gains from additional automation are perceived to be increasingly challenging to capture. Today, a majority of the manual processes have been automated, often with production crews operating machinery from control rooms. Automating the remaining pieces of physical process could prove to be expensive compared with the variable savings it would provide.

TSE’s IJmuiden plant, like many other plants globally and especially in Western Europe, was built with older equipment and assets, with some machinery dating back to the 1960s. Installing new equipment is highly capital-intensive, and, given industry trends, the company did not want to rely merely on funding these types of projects for long-term sources of stable profit.

In 2016, management at the IJmuiden plant began to explore an Advanced Analytics Program as a potential candidate for the Sustainable Profit Program because of belief it may drive long-term profitability benefits. The consideration of AA was not without drawbacks; management expected that an Advanced Analytics Program would come with challenges from legacy systems: In European steel plants, roughly 95 percent of the assets are older than 25 years.18 The technical infrastructure is often outdated as well, leading to data that can be scattered across plants or various IT systems, and sensors that capture inaccurate or inconsistent values. In aggregate, reliable analytical insights can be quite challenging and cumbersome to obtain.

Despite the challenges, an Advanced Analytics Program still appealed to TSE management. It could offer sources of stable and sustainable profit with relatively low investment, while also positioning the company for the future. Typically, people tend to associate automation with job elimination, but AA offered potential for revenue generation and cost savings that were not tied to decreasing human headcount (for instance, more efficient use of energy); this, in turn, could help management maintain strong relations with its labor unions and workforce.

“In the end, it’s all about our customer demand and being able to serve them well,” said the TSE executive in charge of the transformation program. “We found that we needed to step up EBITDA and address our business challenges to fulfill this. How can we think of projects that can deliver EBITDA for the short term but also are sustainable? Out of this search for value, we came across AA as an opportunity.”

3. Move to Advanced Analytics

3.1. Decision to implement AA

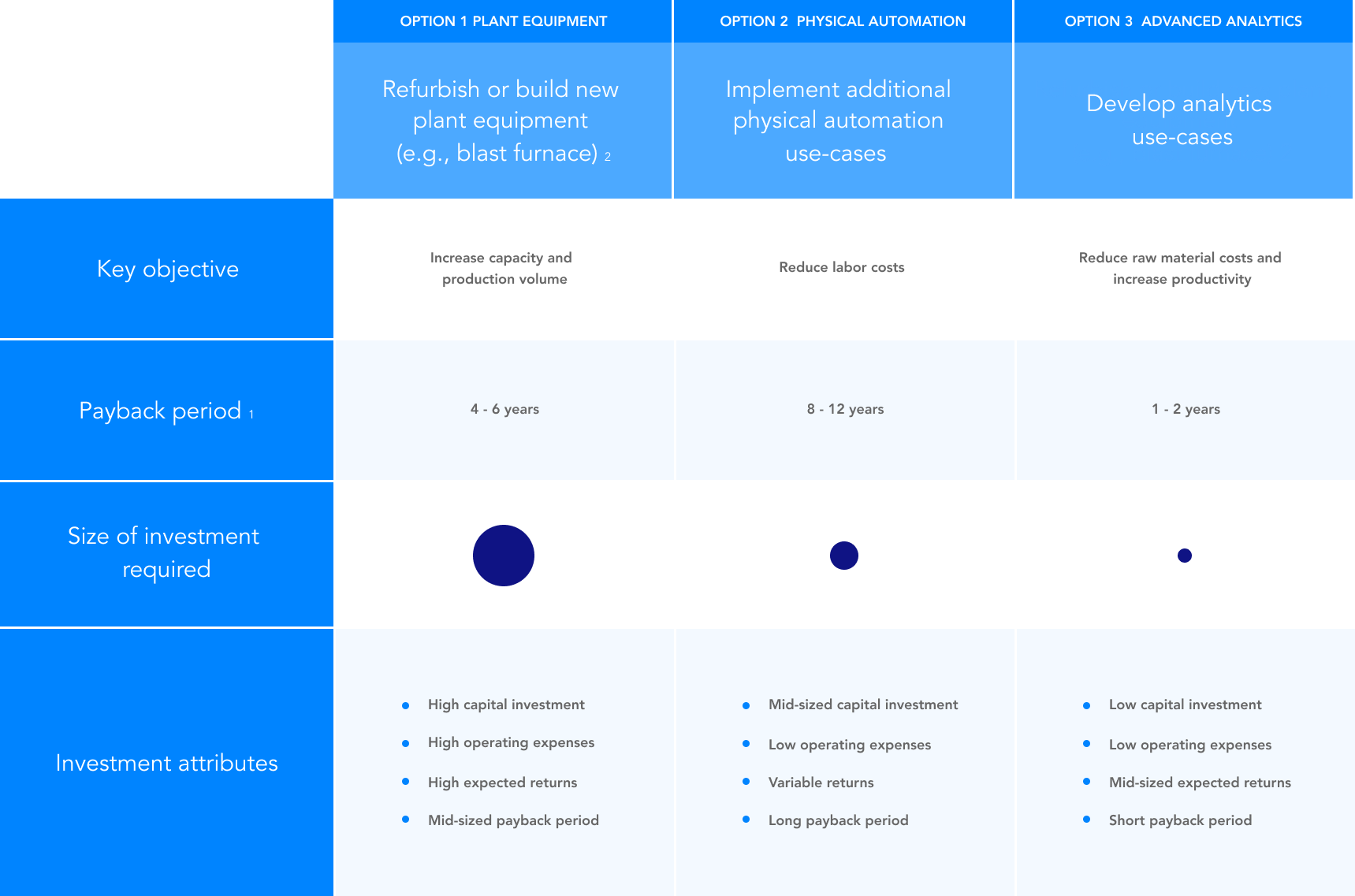

As part of the Sustainable Profit Program, management explored several options to increase EBITDA (See Exhibit 7):

- Option 1: Invest in new equipment, machinery, and plant upgrades. This would require high capital expenditures, offer a high return, and require a medium payback period (the amount of time needed to recoup the investment).

- Option 2: Invest in additional physical automation technology. This would require a mid-sized capital investment and generate a variable return over a long payback period.

- Option 3: Invest in the Advanced Analytics Program. This would require a smaller capital investment and generate a mid-sized expected return with a short payback period.

Comparison of investment options at Tata Steel

These options were not considered mutually exclusive by the management at the IJmuiden plant, and each had their pros and cons. However, given the limited availability of capital, management was reluctant to take on highly capital-intensive investments unless they were critical to running plant operations. Additionally, implementing further physical automation technologies offered limited upside due to the relatively low expected benefits and long payback period.

These considerations made the AA program more attractive than its alternatives. At the time, TSE was engaged in a broader organizational and digitization effort to improve operating routines, improve data capture and quality, and to shift to cloud storage. In 2016, amid this climate, the company evaluated using Advanced Analytics to improve its manufacturing operations. TSE management decided that they needed to complete the digitization effort first, though, so they would have the technical infrastructure in place prior to initiating the Advanced Analytics Program.

“We tried to demystify digital issues — in the end, it’s all about new and old sensors of data, integrating it into the cloud in a centralized place, and improving the models on top of that,” said the TSE executive who directed the transformation program. “We developed a digital roadmap so that [our employees] understand where the pieces fit together in our broader strategy.”

3.2. Management team’s view of Advanced Analytics

Tata Steel Europe’s management team saw significant opportunities presented by the Advanced Analytics Program, as well as its limits and potential challenges.

According to management, launching AA offered a variety of benefits:

- AA is a low CapEx,19 high-return investment: Process improvements and cost savings driven by Advanced Analytics can achieve the comparable results of alternatives that require large capital expenditures, such as investing in a new blast furnace (an investment on the order of hundreds of millions of Euros). The TSE executive who oversees the Advanced Analytics program noted, “It is much cheaper to invest in AI than to invest in a new blast furnace. This gives us a chance to achieve similar magnitudes of impact without large CapEx investments.”

- AA could target the largest cost drivers: Raw materials are the largest cost driver for the steel plant, and AA presents an opportunity to address this cost driver given the availability of data related to raw material processes.

- AA could improve product quality: High-quality products differentiate the company in a competitive market. The program presents opportunities to improve customer relationships through higher quality products and to increase margins through better pricing.

- AA use cases did not focus on labor reduction: The AA effort was very value-driven and needed to demonstrate direct impact on EBITDA to be approved. In sizing the value of potential use cases for the AA program, value was most often identified through yield or throughput improvements rather than labor reduction. Management preferred to create value through revenue generation or non-labor operational savings (consistent with no direct labor reduction achieved in AA’s implementation).

- TSE has the talent to drive AA implementations: Tata Steel Europe takes pride in its workforce and has rolled out a variety of training initiatives to give its workforce the skills and tools to develop and implement Advanced Analytics use cases. TSE’s engineer-heavy workforce was highly comfortable with analytics and large data sets, based on internal assessment, and could thus be trained with the right toolkit for more advanced analytical techniques. As one TSE executive noted, “We have a large population who are very connected to this type of work. We don’t hire a ton of people externally, but we train them up from our incumbent population of process engineers […] The results have not let us down at all.”

Still, management clearly sees AA not as a panacea but as one new tool for the continuous process improvement that is critical in the competitive steel industry. The management team has looked for use cases with certain features that make them good candidates for AA – for instance, data availability and quality, as consistency across various plant sensors can be a challenge. Management also looks for a compelling business case, such as addressing one of the major business challenges or cost drivers (e.g., raw materials savings, process stability improvements). “When we were in discussions about this strategy two or three years ago, we saw AA not as a magic wand, but a practical way to improve our business and processes,” said the technical director of TSE’s AA program. “We have positioned this program as something that serves all other improvement programs, such as quality improvement. AA is just one of the methods that we use.”

Once Tata Steel Europe’s management team committed to the Advanced Analytics Program, they were determined to mitigate the cultural and technical challenges that might be brought forth by a transformation effort. Planning for change management was a conscious part of the program’s upfront strategy. This planning included two key areas:

- Investment in training programs: Management was willing to invest resources for (ongoing) training programs to give a portion of their workforce the necessary skills to develop machine learning and statistical models, to work in agile teams, and to translate findings into actionable recommendations. The training even included executives and the CEO, to demonstrate that a successful implementation of AA could take place only when the methodology is understood at all levels. As of this writing, roughly 200 FTEs have been trained through these programs (see Section 4.2 – “Training teams and working model” for further detail).

- Executive sponsorship: Management knew that sponsorship, both in terms of funding and creating project owners, would create more organizational momentum. Executives would not treat the program as a side project but as a central part of the organization’s strategy.

3.3. Evaluation of AA initiatives

Tata Steel Europe found no shortage of ideas when it came to AA initiatives and use cases, which constituted a multi-year effort with specific annual savings and EBITDA uplift targets.

Rather, the challenge was choosing where to focus – and then implementing the initiatives (e.g., developing models, incorporating change management, and updating infrastructure as needed). The team evaluated the potential of AA initiatives along a variety of dimensions, including value potential, data availability and quality, whether they had sufficient complexity to warrant the use of advanced analytical techniques, implementation feasibility, and buy-in or sponsorship from at least one company executive.

To gauge success of an AA initiative, each use case had specific metrics for monitoring and tracking progress. Use cases were expected to demonstrate improvements over a defined period of time, typically from six months to a year. In the initial wave of use cases, prioritization was largely driven by data availability and quality, as well as the impact on the biggest cost drivers, such as raw material optimization. As of late 2018, Tata Steel Europe has implemented about 15 use cases of advanced analytics across its steel manufacturing operations, with 30 more under development. More than 200 use cases have been identified for future phases of the program.

3.4. Setting goals and KPIs for AA initiatives

At Tata Steel Europe, AA use cases are treated as any improvement project, requiring rigorous performance tracking measures such as key performance indicators (KPIs). A specific KPI is tracked for each use case depending on its core objective, such as yield improvement or reducing the rejection rates for product quality standards. For example, one use case’s KPI focused on reducing the rejection rate for a quality assurance test of a key product.

Each use case is assigned a target to hit. While metrics are often operational KPIs, each use case needs to have clear financial benefits and is expected to break even financially in a defined period of time. The use case project team develops a business case with clear targets, to be presented to an evaluation committee with an executive’s sponsorship. Since launching the AA program, some use cases have been more successful than others, with a few significantly outperforming the initial target and others realizing benefits below the initial targets. Overall, however, the program has exceeded its target across the portfolio of use cases.

4. Development of AA initiatives

4.1. Breadth of AA initiatives

In the initial phase of Advanced Analytics at Tata Steel Europe, the company prioritized 15 use cases, each focusing on a different process or approach, ranging from energy reduction to product quality improvement to raw material savings.

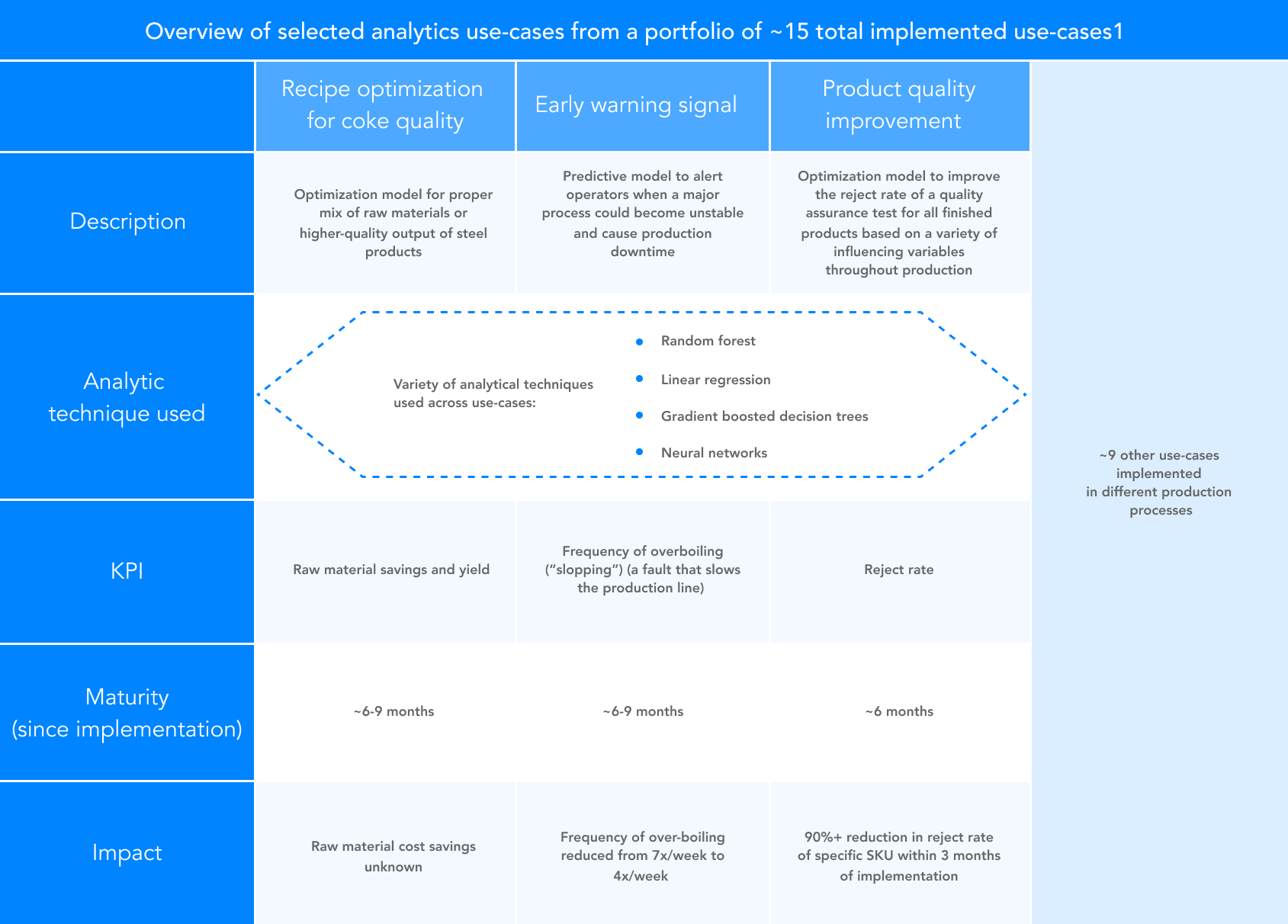

Examples include (See Exhibit 8 for more details):

- Recipe optimization for coke20 quality: Model to improve the optimal quality mix of raw materials to reduce raw material costs with a similar- or higher-quality output of steel products.

- Early warning model to reduce downtime in the steel plant: Predictive model to alert operators when a major process could become unstable and cause production downtime and productivity losses.

- Product quality improvement: Project to lower the rejection rate on a quality assurance test for finished products.

Today, most of the AA use cases focus on direct manufacturing improvements. Other corporate functions, such as supply chain, procurement, sales, finance, or human resources, may be addressed at a later stage.

Overview of select AA use-cases across the portfolio

4.2. Training teams and working model

Around 200 FTEs, including data engineers, data scientists, project managers, and company executives, were trained in various analytics courses. Of those, about 50 actively developed the use cases and built models. Training was relatively rigorous, in some cases including up to 70 hours of cumulative training for more technical roles.

Advanced Analytics teams were cross-functional, including data scientists, data engineers, and subject-matter experts (such as plant operators), to encourage collaboration and ensure that people with different areas of expertise were heard. Teams sometimes included user interface designers to build out digital tools, so executives and production crew teams could interact with the analytical models. The

teams worked in an agile21 manner over 10 weeks to develop iterations of analytics use cases, extracting and assessing data and designing actionable projects.

To strengthen these teams, Tata Steel Europe sought to find hybrid candidates from within the company who were knowledgeable about steel operations and about data science to develop machine learning or statistical models. As an executive noted, “We are in the business of making steel. We are not in the business of developing the best AI algorithms. The objective of the analytical models is to help us make better steel. You need to know both.”

4.3. Data sources

As part of transformation efforts, Tata Steel Europe has been shifting its data storage to the cloud, while also undertaking an effort to increase data centralization, accessibility, and quality. As part of the AA program, the company has also expanded its data-capture techniques across the IJmuiden plant, including standardizing data capture and leveraging data-capture techniques for unstructured data such as audio and images.

Most of the available high-quality data was already well-structured as it was sourced from plant sensors. Therefore, more advanced machine learning techniques, which are uniquely suited to analyze unstructured data (such as audio or images), might have provided less incremental benefit over less sophisticated analytical techniques at that point. In some cases, however, Tata Steel has been working on using unstructured data from “smart” cameras and listening devices. In the early warning slopping22 use case, for example, the team has started to incorporate images and plant audio to predict if the furnace may overboil leading to production downtime.

4.4. AI techniques used

The teams working on the portfolio of AA use cases considered and used a range of techniques — from simple linear regressions, to Monte Carlo methods, to more advanced random forest models — with the next stage of more mature projects testing neural networks. The type of technique used depended on the amount of data available, quality of the data, and the type of problem (e.g., multi-dimensional vs. fewer variables).

The teams discovered that more advanced techniques (e.g., neural networks) did not always generate the best results. As data availability and quality increase, this could change, making more advanced techniques more viable. However, the more advanced techniques were often more difficult to develop and implement — and they have not yet been proven to show significant business impact.

4.5. Challenges in AA implementation

4.5.1. Infrastructure challenges

From a technical perspective, challenges often revolved around data engineering rather than the development of analytical models. To be successful with more advanced analytical techniques, it was necessary that many data streams were readily available and were properly cleaned and interconnected. Data centralization and accessibility was greatly enhanced by a cloud-based IT and data infrastructure that was developed during the launch of AA initiatives.

At one point, different processes and plants used different database types and servers. The company’s IT infrastructure could not support advanced analytical techniques due to fragmented batch data storage. Then the company began its shift to the cloud, centralizing data sources for easy access.” We create so much data in our production process, but it’s all in scattered databases with a terabyte here and a terabyte there, and we only use a small part of that,” said the director of the transformation program at TSE. “When you do AA, you need to tap into the cloud to centralize it all.”

4.5.2. Data quality challenges

The quality and consistency of the data was another major hurdle. Sensors across plant operations could be decades old or improperly calibrated, and poor-quality or incorrect data could lead to improper or misleading training of analytics models. The data engineering team needed to invest significant time into cleaning and structuring the data to ensure that data reliability for the AA use cases. Often, the manual effort of data cleaning was done on a case-by-case basis.

The major challenges in data quality highlighted the need for TSE to invest in new data sensors across the plant and to standardize data cleaning practices to lay the foundation for future AA use cases. Change management, for both the management team and direct manufacturing staff, was often highlighted as one of the most significant challenges in implementing the Advanced Analytics Program. When done effectively, however, it also proved to be one of the most important drivers of implementation success. “People are an important factor. After we built models, we had to convince the operators to use the models,” said an Advanced Analytics project manager.

Data scientists implementing models in plants found that plant operators could be initially reluctant to use or trust the analytics model, and often trusted the “old way of doing things” more than a model that could not be fully explained (because of the computation-intensive statistical techniques on which it relied). There was also a sense of pride in the domain expertise that had been previously been developed through years of on-the-job experience. Yet, according to AA project managers and plant managers, operators tended to be impressed by the results and would start trusting a model if, for example, it was effective at signaling a potential break-down in a process. From management’s perspective, the operators did not fear technology in general, but they needed to build trust with the new technologies and recommendations.23 Explaining the model’s recommendations in a way that translates to how an operator understands the process proved critical for earning their support.

Data scientists and plant managers cited two strategies that proved effective to get buy-in and to increase the adoption of the analytical tools:

Get input early on from domain experts and plant operators: Bringing domain experts, such as plant operators, into the problem-solving and development of the model early on led to far better results than having data scientists work separately, both in the model performances and in the buy-in from the operators. Management reported that, following this process, the operators were less likely to perceive the recommendations from the AA model as telling them they were doing their job wrong. One plant manager required data scientists to be in the same room as operators during the model development: “We wanted [data scientists] not to sit in a room far away, and instead [to] spend two days each week inside the steel plant,” he said. “It’s necessary to make sure that the operators and our production crew are involved in the AA program together.”

Use data visualization tools to help operators understand the model: Analytics project managers also realized the effectiveness of building user interface and data visualization tools deployed on tablets to help users more easily understand the rationale of the AI system and interpret the outputs of models. Digital tools such as tablets could help operators understand the recommendations in language that could be easily understood and also allowed operators to interact with the results of the models through digital interfaces or visualizations. “We are thinking more and more of moving from models to tools that other people can use, so it is more empowering to the people that are in the plant working with it,” said an AA project manager.

5. Observations

5.1. Business and productivity impact

In its first year, management reported that the Advanced Analytics Program at Tata Steel Europe had a direct and meaningful impact on profitability (e.g., EBITDA). For instance, management found that the AA program increased productivity at TSE overall, a key metric in the steel industry, by delivering roughly 13 percent higher EBITDA with the same production staffing levels. The initial phase of use cases focused on the “low-hanging fruit” implementations, often driven by data availability and ease of implementation. More advanced use cases may require increased investment; however, executives expect the future returns to be potentially higher than the initial phase of use cases as more advanced techniques are used or as AA is implemented in higher value processes.

5.1.1. EBITDA impact with high ROI

All the Advanced Analytics use cases implemented in the program’s first year had a substantial EBITDA impact for the IJmuiden plant, though some use cases did deliver value beneath their initial target. One TSE executive noted that the AA program overall exceeded its initial target. According to a technical director at Tata Steel, the use cases the AA program focused on were “issues we could not have solved with conventional improvement methods.” He expects the benefits to continue.

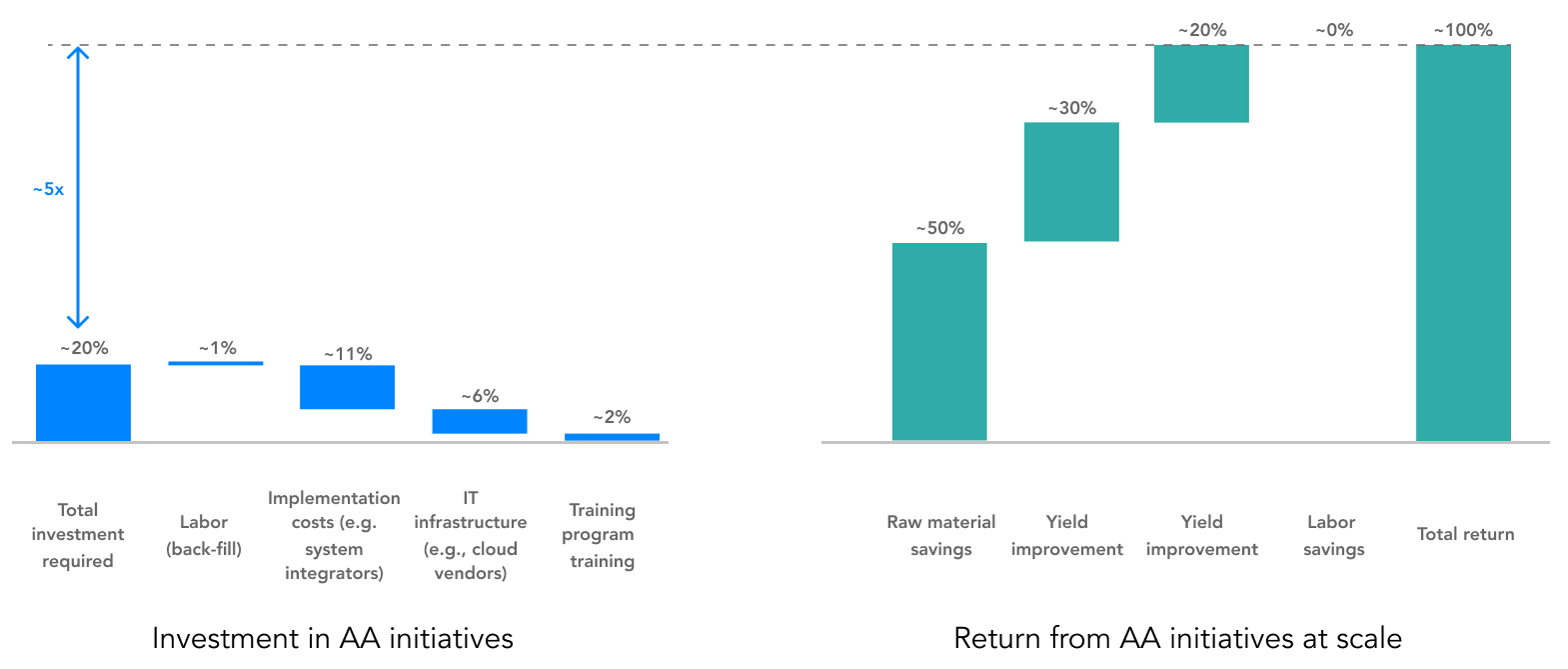

From managerial perspective, Advanced Analytics proved to be a very efficient use of TSE’s capital and resources compared with alternative investments, such as new plant equipment (e.g., a blast furnace) or physical automation technologies: It required lower upfront investment and had much higher return on investment (ROI).

Advanced Analytics program yields an estimated 5:1 ROI

“For every dollar invested, we received $5 in return,” one TSE executive reported (See Exhibit 9 for details).

The financial benefits took a variety of forms, primarily through direct savings on raw materials and yield improvement, as well as indirect margin improvement from higher-quality products (and the consequent shift toward higher prices earned). The investments in the program included setting up and implementing the program (e.g., costs associated with digitization effort), training employees, and labor to develop and implement models. Additional costs include some of the IT infrastructure, such as cloud storage; these costs are not insignificant, but also were not major cost drivers.

5.1.2. Varying benefits across use cases

The portfolio of AA use cases had a significant impact on the business, though the size and type of benefits varied across the 15 AA use cases implemented to date.

For example, one of the most successful categories of use case implementations focused on process stability improvement and led to roughly 20 percent of total benefits realized from the AA program.24 In one of these use cases, the quality control rejection rate for a product was reduced by 95 percent in just three months.

Due to the company’s thin operating margins (typical across the industry), even small operational and productivity improvements (e.g. yield) can have large impacts on TSE’s profitability.

5.1.3. Raw material savings and yield improvements

As noted above, the financial benefits from the 15 AA use cases implemented to-date come largely from raw material savings and yield improvement, not through labor reduction. Raw materials savings accounted for 50 percent of total program benefits and yield improvement about 30 percent. There have been no direct labor cost savings to date. The initial analytics use cases were chosen because they focused on IJmuiden’s largest cost drivers, such as raw material costs, rather than labor.

In addition to these direct savings, the use cases have also produced indirect financial benefits through other margin improvements. A focus on product quality improvements has allowed the company to expand its book of business on higher-quality and higher-margin products. This is particularly helpful within the automotive sector, for example, where quality is important for manufacturers and is a strict regulatory requirement. Higher product quality also leads to higher customer satisfaction, which is critical given the excess capacity in the industry and the struggle to sell a company’s full supply of steel.

5.1.4. Rapid model development, longer implementations

Since beginning the AA program two years ago, the team at TSE reports they reduced the time required for analysis and AA model development from about three months to 30 minutes – yet this is only one part of the overall process (and model development could take longer in novel use cases). In general, TSE found that developing an analytics model takes a fraction of the time associated with cleaning the data and implementing a model on existing production processes. The AA initiatives have improved the efficiency of labor focused on analytical model development, though other significant enablers remain in the process. “The challenge for us today is that we can’t keep up with all the strong ideas we have generated by AA,” an AA project manager said.

The team hopes to expand the impact of the AA program into areas such as research and development, specifically about the chemical properties of steel. “There is going to be much more data coming out of these initiatives,” said a senior executive at Tata Steel Europe. “We are only just scratching the surface. I think we could be doing a lot more to make completely un-thought of types of products.”

5.2. Workforce impact

This case demonstrates how one company avoided immediate AI-related workforce reductions by retraining employees and committing to retaining them through retirement age. It is not always the case that AI implementation results in immediate workforce reductions. Instead, introducing AI technologies may affect the workforce in other ways.25 In some cases, AI can lead to quality improvements that were previously unattainable. In others, the goal of using AI may be to reduce non-labor costs. The steel industry, even before AI and AA technology, had already witnessed a significant reduction in employment due to automation, which limits the potential savings of further reducing labor costs. In the case of Tata Steel Europe, the AA program had less impact on the size of the workforce than on training, workforce tasks, and hiring dynamics — partially driven by the design and intentions of the AA program. Yet even at TSE, in the automation-heavy steel industry, core business functions remain that may also see transformations with AI’s incorporation, such as procurement and finance. As these functions have not yet been subjects of AA use cases, there is not case-specific evidence of workforce impact in these domains.

5.2.1. History of physical automation at TSE

Tata Steel Europe has had an industrial automation program for more than a few decades, while the AA program started less than two years ago. This physical automation technology — which has operators overseeing processes but computer-controlled machines performing them — has already provided major labor efficiency gains: As noted earlier, twenty-five years ago, the IJmuiden plant produced 3 million tons of steel annually with 23,000 FTEs. Today, it produces 7 million tons of steel with only 9,000 FTEs.

At TSE, the legacy physical automation programs address different types of problems than AA and thus provide different benefits: The legacy programs mostly address highly repeatable tasks, such as moving materials from one area of a factory to another. This is in contrast to today’s AA use cases, which tend to focus on more complex problems that have traditionally been solved through employees’ experience (in combination with other technology – for instance, in manually configuring settings on a computer or monitoring system). Over time, TSE’s industrial automation reduced FTEs and improved safety and process stability, reportedly leading to higher-quality products; AA has achieved similar types of stability gains, though without direct labor reductions to-date.

Another difference between the legacy systems and AA is the development lead-time: Physical automation in the steel industry has often been developed incrementally over many years, while AA can be implemented more quickly and requires lower levels of upfront investment (See Exhibit 7). AA use cases have been able to be developed and implemented in 10 to 12 weeks if there is value potential, relatively straightforward implementation (e.g., implementing a recipe change), and available data to feed the model.26

Today, the Advanced Analytics use cases offer a significantly higher return on investment than physical automation cases at Tata Steel Europe. Because the IJmuiden plant has been automating its manufacturing processes over the past two decades, a large amount of the physical automation potential has already been achieved. What remains for physical automation are processes that are more difficult to automate, require heavy investment upfront, and have lower incremental savings opportunities, mostly on labor costs. AA, on the other hand, addresses different types of problems, typically not focused on labor reductions but rather on raw material savings or yield improvement. For example, with no incremental physical automation, a plant may require an operator to run a train transporting materials from one location in the plant to another. With five production shifts per day, this would require 5 FTEs total to operate the train. The upfront investment required for physical automation significantly outweighs the cost saving benefits (reducing workforce by 5 FTEs) (see Call-Out: Physical automation example: Torpedo Tapping).

Physical automation example: Torpedo Tapping

A physical automation case at the IJmuiden plant illustrates the difference between the objectives and nature of physical automation and Advanced Analytics at Tata Steel Europe.

TSE worked for 10 years in total to fully automate a process that required 10 FTEs to operate. This process involved moving a vessel of liquid hot metal, or a “torpedo car,” from one part of the plant to a downstream site. Initially, an operator would control the process remotely from a control room, yet this process was slowly replaced by physical automation, using cranes, cameras, sensors, and rules-based computer software.

The effort to incrementally automate the process began in 2005. At first, two operators would control the movement of torpedo cars and the pouring of hot metal from a control room using joysticks, spread over multiple shifts per day (10 FTE total). By 2015, the process was fully automated. A fail-safe mode now allows for a human to intervene and take control if the process fails.

The company faced several challenges in automating this process, including making sure that the operators’ skills did not atrophy through continued employee training, so they could step in if the system failed.

In this case, the physical automation led to consistent execution, improved safety, and fewer incidents and maintenance costs. The incremental value of implementing AA for this use case is not clear, so there are no plans to use AA-developed models within this process.

5.2.2. Workforce size

Automation technologies have been TSE’s major driver of productivity improvements (including workforce reduction) over the past decades; AA initiatives, in the past two years, have focused on identifying next-level potential process improvements and do not directly focus on labor reduction. So far there have been no known workforce reductions attributable to the AA program at TSE. Instead, as stated above, the focus has been on product quality improvements, raw material cost savings, and partial process improvements rather than full automation and labor reduction. These areas of focus are expected to continue, at least in the short-term.

While AA is not expected to result in any layoffs in the short-term, the cumulative impact of AA initiatives includes increased labor productivity, in the form of either or both greater output (e.g., volume of steel production) at the same levels of staffing, or more profitable production with similar staffing (e.g., non-labor cost savings per unit of output).

Aside from direct labor reductions, companies may choose to reap such labor productivity gains through reduced rate of hiring in the long-term future. For TSE, this consideration holds particular importance, since they may face a large voluntary attrition of their workforce as their operators increasingly reach retirement age.

5.2.3. Shifts in workforce tasks

AA use cases are changing the nature of work at TSE, even when there is no impact on the size of the workforce. For example, operators at TSE are typically responsible for several tasks, of which AA may only be “replacing” one. Therefore, replacement of a task through AA may free up time for workers to focus on other activities that remain on their docket. In other processes in which AA use cases were implemented, operators’ work appears to have shifted toward leveraging recommendations from AA user interface tools in their activities, instead of relying only upon their domain expertise as they had previously. In aggregate, workforce reductions may arise in the long-term future if several more advanced AA use cases are centralized and woven together, though in the interim, it is likely that those plant operators would be relocated to different processes in the plant.

For TSE’s data science and engineering teams in particular, work has shifted more than for plant operators – with a change from data collection and cleaning to data analysis.

“Gathering data for the first analysis is far easier and far quicker than we used to do it. It used to take 2-3 months to do a first analysis. At the moment, it’s just a click of a button for the first analysis — we can do it in 30 minutes. That’s very powerful, and it accelerates the whole process.”

Technical Director of the AA program

What do the [Advanced Analytics] teams do with excess time [now that data has become more available and standardized]? First, there is no shortage of problems to solve and implement. The focus has shifted to effectively implementing the analytics versus developing valuable analytics. As for the mid-to-long term: ‘Too early days to comment on that.’

Technical Director of the AA program

5.2.4. Workforce training

Instead of hiring external talent for its AA program, TSE invested in training about 200 FTEs at various levels of seniority, including the CEO, managers, engineers, IT staff, and staff from non-technical functions. The company looked internally for talent rather than externally for several reasons: For one, TSE determined that training internal workers is more cost-effective and easier than hiring in-demand scientists from top technology firms. Additionally, TSE’s employees are proud to work there and were motivated to “work on the future” of the company, according to management’s internal surveys on the AA program. Importantly as well, TSE found that internal domain experts who had received data science training were much better positioned to develop AA models than outsiders with no steel-sector expertise.

“We started with training our senior management, literally with the CEO and then all the way down. We felt that if it is not understood by senior management, it won’t be successful,” one TSE executive said. Advanced data scientists received two extra days of training to allow them to build more complex models.

TSE’s production crews did not receive formal training but did receive on-the-job training on how to implement recommendations from an AA model. The AA teams have also started developing user experience and visualization tools so that the production crew is able to understand the AA models without much data science training.

Of note, employees’ wages also did not change through this process or as a result of the training. According to management, the program was enthusiastically received by employees: “People are way more motivated and they feel they own the work,” a TSE executive said.

5.2.5. Changes to hiring dynamics

The AA program has also enabled TSE to attract new talent where necessary — such as people with hybrid profiles in physics and data science. A secondary effect of the initiative is that TSE has developed better connections to universities, and has now developed a pipeline of new workers through the AA program for future hires.

5.2.6. Potential medium- to long-term impacts on workforce

While no workforce reduction can be ascribed to the AA program yet, the medium- to long-term impact on the workforce from AA at Tata Steel Europe is unknown. However, trends seen today may offer some clues. The production workforce is aging, and many will retire in the next five to fifteen years, taking with them experience and knowledge that would be difficult to replace through training. This, coupled with productivity gains from AA, might lead to a slower hiring rate.

Some within the company believe that there will likely be some labor impact in the coming years as both the analytics and the physical automation technologies mature. Even with this maturing, however, TSE remains constrained by contextual factors, such as labor unions or regulations that may influence decisions on whether to pursue labor reduction.

Though it is difficult to estimate which types of workers are most likely to be impacted at TSE, one may begin to speculate. For instance, more-autonomous AA use cases may replace certain tasks of a plant operators in the long-term (e.g., early warning model preventing overboiling) or may require fewer of these operators. On the other end of the spectrum, demand for data scientists and data engineers will likely increase as the AA program expands; however, these could be internal transfers rather than external hires, as in TSE’s experiences to-date. Additionally, more-advanced tools and best practices for data engineering may entail a need for fewer of these roles as well; extrapolating to future employment figures remains a challenge from TSE’s experiences.

Outside of TSE’s steel manufacturing processes, the company may also see impacts in other domains: For instance, the scope of AA use cases could span other corporate functions such as HR, procurement, and finance, requiring shifts in tasks and skills. “I don’t see a single group that will not be affected,” said the AA program’s technical director.

For now, these micro-trends observed in the TSE workforce bear watching:

- Increased demand for data scientists, data engineers, and business “translators” as the Advanced Analytics Program expands to other corporate functions (e.g., HR, finance, procurement).

- Increased demand for hybrid skill sets (e.g., backgrounds in both physics and data science).

- Increased need for retraining (e.g., process engineers retrained as data scientists for the AA program).

- Potential reduction of the production workforce in the mid- to long term as AA and automation programs mature and start to converge; likely no workforce reduction in production crew in the short-term.

- Decreasing size of the workforce in the long-term through worker retirements, coupled with lower hiring rates.

6. Reflections and implications

6.1. Reflections

6.1.1. Change management

Change management was one of the biggest factors in the successful AA implementation at TSE. The management team used several key strategies for getting employees’ buy-in on the program:

- Executive sponsorship and clearly defined goals: From the program’s inception, Tata Steel Europe had multiple executive sponsors driving the change from top to bottom. Management reported that this approach was critical to create the organizational momentum, to allocate proper funding and resources, and to develop clear and actionable goals. The ease of getting employee buy-in also depended on the desired goals. For example, it was easier to get production crew support for a use case focused on raw material savings or overboiling than for one where anonymized data of individual workers would have to be used as inputs.

- Cross-functional teams and early involvement: Having domain experts participate in creating the AA models led both to better working models and to increased buy-in from the manufacturing staff.

- Across-the-board training: TSE launched a training program for 200 of its employees at all levels of seniority to provide analytical, implementation, and communication skills and trainings.

- Explainability of models: Especially in the initial phase of the AA program, operators were more inclined to implement recommendations that came from models they could clearly understand. The technical implementation teams realized that explainability is a driver of adoption, so they would often favor less-advanced techniques in models if the models could then be explained to operators more easily.

Introducing more advanced analytical techniques and process automation can naturally introduce fear or tensions in the workplace. As a project manager reflects, “there have always been people who fear machines will take over.” On one hand, some within TSE claim that AA introduces more empowerment and excitement for the production crew. On the other hand, generating trust in new technologies is often a challenge: As one interviewee reported, “there are always people that say, ‘I’m an expert in that, are you going to replace my expertise?’”

Underlying many of these transitions is a thread of communication, which is important in any workplace environment. TSE found that explanation of the technology, trust in new systems, and transparency around objectives are important to get buy-in across different stakeholders. Involving different groups in the decision-making and development of tools can also help to create support and feelings of ownership in the transitioning workplace.

6.1.2. Business and productivity impact

Since the launch of the Advanced Analytics Program at the IJmuiden plant, Tata Steel Europe management has viewed analytics and machine learning as another tool for continuous improvement and a way to stay competitive in a highly commoditized and capital-intensive industry.

TSE finds the AA program to have increased productivity at TSE overall, a key metric in the steel industry, by delivering roughly 13 percent higher EBITDA with the same production staffing levels. TSE reports that this has generated significant financial benefits: In its first year, it generated $5 in financial benefits for every dollar invested. The benefits came largely from savings on raw materials and yield improvement. The company also saw indirect margin improvement by shifting toward higher-quality products, and expects better customer satisfaction as a consequence. To implement this program, TSE needed to invest in areas such as back-filling labor positions pulled in to deliver the project; TSE’s IT infrastructure and system upgrades; and in employee training.

AA is not a panacea — it is a particular set of analytics tools suited for specific types of problems. At TSE, the project team found that it is best-suited for complex problems where the optimal solution is still largely unknown. Analytics models helped “connect the dots” in processes that were not connected in the past, pulling together fragmented sources of data and standardizing data quality across the organization. These solutions would help to reduce the reliance upon operators’ intuition, developed through years of experience.

For example, to predict overboiling in the steel plant, domain experts would typically have looked for certain sounds or furnace characteristics that could signal that an overboiling was imminent; analytics would take hundreds of variables, including plant audio data, to predict if overboiling would occur. Yet this shift does not entirely displace the importance of domain expertise: Instead, the domain experts’ knowledge is still needed, both to create the initial AA models and to check and understand the data.

6.1.3. Workforce impact

While no workforce reductions can be ascribed to the AA program today, the potential for medium- to long-term workforce reductions could be sizable as the AA initiatives mature and evolve across the organization, as well as the industry.

In the past, workforce reductions at Tata Steel Europe have been achieved through physical automation, replacing manual tasks of operators. Yet, as we have learned, different than past physical automation, AA use cases tend to focus on raw material optimization or quality improvements, which do not lead to labor reduction.

While AA is not expected to result in any layoffs in the short-term, there is a chance that the production workforce could be impacted as Advanced Analytics use cases mature. In addition, the cumulative impact of AA initiatives over the mid- to long term could potentially result in a reduced rate of hiring. This is especially important for TSE, as it faces a natural reduction in its workforce from upcoming retirements and voluntary attrition. The industry’s unionization and regulated nature may also directly or indirectly influence decisions made around AI-related efforts.

6.2. Conclusion

The steel industry has continuously transformed over the past decades. Intense competition has pushed companies to achieve higher operational productivity and efficiency levels, creating leaner organizations and lowering their cost base. With these goals in mind, steel manufacturers have redesigned their processes, automated manual tasks to the extent possible, and made their operations more efficient. As a result, the industry has seen an ongoing decline in direct employment over the past half century. In the U.S., for example, labor productivity (output per worker) grew by a factor of five from 1962 to 2005, which enabled significant workforce reductions.

Continuous improvement and innovation have been Tata Steel Europe’s guiding principles for many years as a result of operating in this commoditized, highly-competitive, and capital-intensive industry. Over the past decades, the company undertook major physical automation and operational efficiency programs. In the past two years, it identified Advanced Analytics applications and use cases to continue this ongoing improvement, though with somewhat different features than past transformations.

TSE’s use of Advanced Analytics demonstrates how AI can create value in capital-intensive industries, such as in the steel industry. After investing in its IT infrastructure, compiling its data sources, and standardizing its data quality, TSE reports that it was able to quickly implement key Advanced Analytics use cases and reach ROI levels of $5 for every $1 spent in the program’s first year. Additionally, TSE was able to make an impact with advanced analytics algorithms without having the most sophisticated technology infrastructure or tapping into the external labor market for top data science talent. Instead, the company was able to train its existing technical teams and equip them with the skills needed.

Yet TSE’s Advanced Analytics integration was not without challenges; issues such as the availability, connectivity, and quality of data; systems and IT readiness; organizational buy-in; and change management needed to be overcome to help steward this business-value.

For labor specifically, the case of Tata Steel Europe raises questions about the future of the workforce in the steel industry (See Appendix 7.1 for open questions for further research). Though the AA implementations did not lead to any layoffs, this was largely due to the unionization of the workforce at TSE. Yet, the company was still able to increase worker productivity through improved yield and more efficient use of raw materials. In the future, these improvements may lead to workforce reductions, perhaps through retirements and voluntary attrition as TSE’s workforce ages. While TSE illustrates a positive use case of a company that was able to successfully re-skill its own workforce internally and introduce AI without any layoffs, it remains to be seen whether this will be replicable at scale and in contexts without strong union protections.

7. Appendix

7.1. Questions for future research

The Tata Steel Europe case study raises a number of questions that could be addressed in future research.

One question of note is the likely progression for labor as Advanced Analytics use cases become more mature: For instance, in one system, what began as a predictive early-warning tool for operators’ use has evolved to a fully autonomous system, in which an operator does not intervene. As the AI-related technologies at TSE mature, it is likely that they will start to intersect with existing automation programs or expand to further use cases outside of production (e.g., use cases in procurement, finance, HR), which may lead to job loss, or may allow employees to focus on other areas of the company’s operations.

Complicating these dynamics is TSE’s aging workforce: If TSE does not reduce its dependence on labor, how might the company be affected in coming years by lower availability of workers? Will there be further economic savings in the form of raw materials and yield, or will the AI wave look similar to the physical automation wave of the past few decades, leading to reductions in the workforce? It is unclear what these questions will mean in sum for the future of work at TSE’s IJmuiden plant and for incumbents of older industries in general as they adopt AI to remain competitive.

7.2. Exhibit 2. Business summary of the IJmuiden plant

Business summary of the IJmuiden plant for Tata Steel

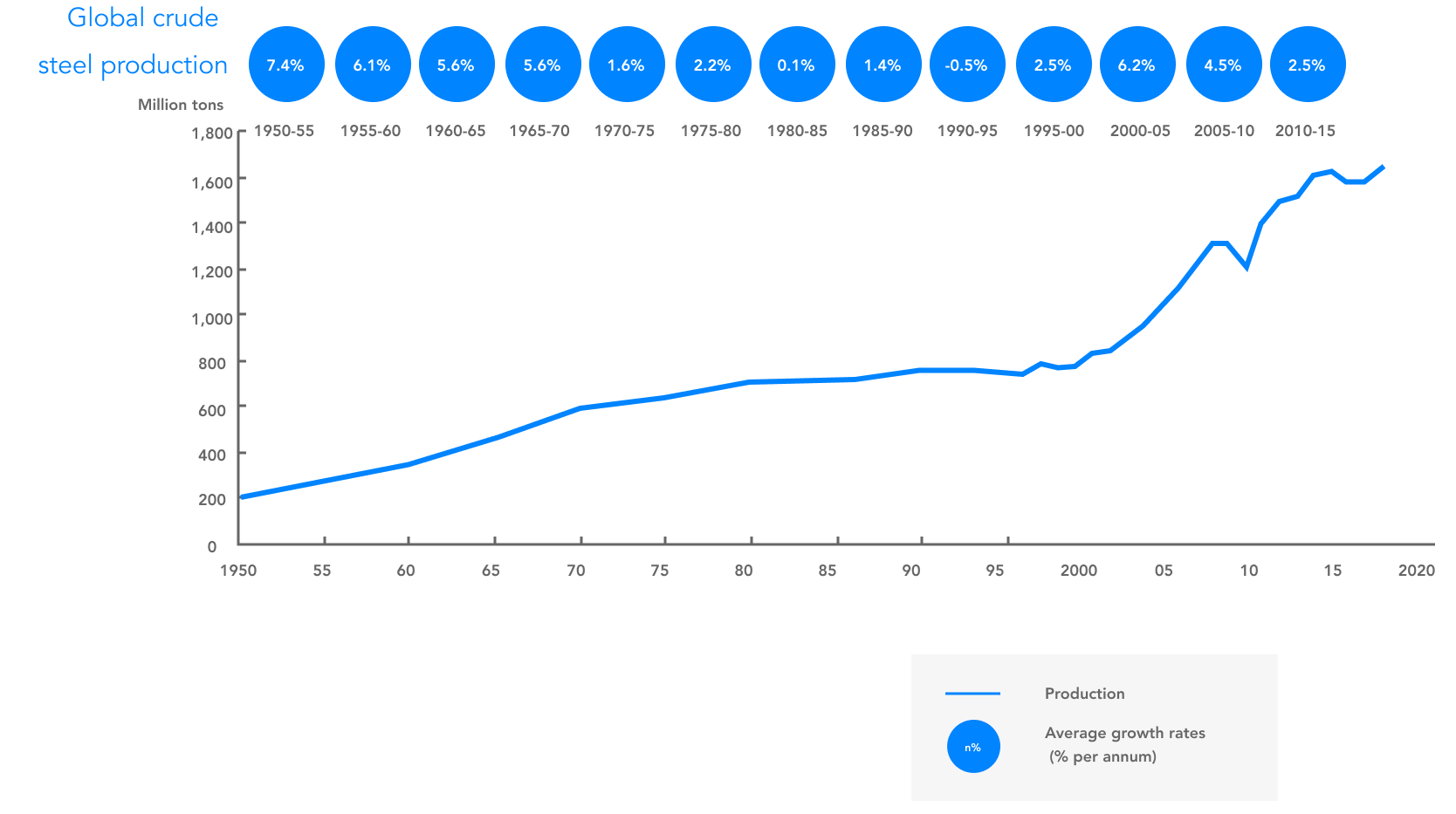

7.3. Exhibit 5. Global steel production

Global crude steel production, 1950 to 2015

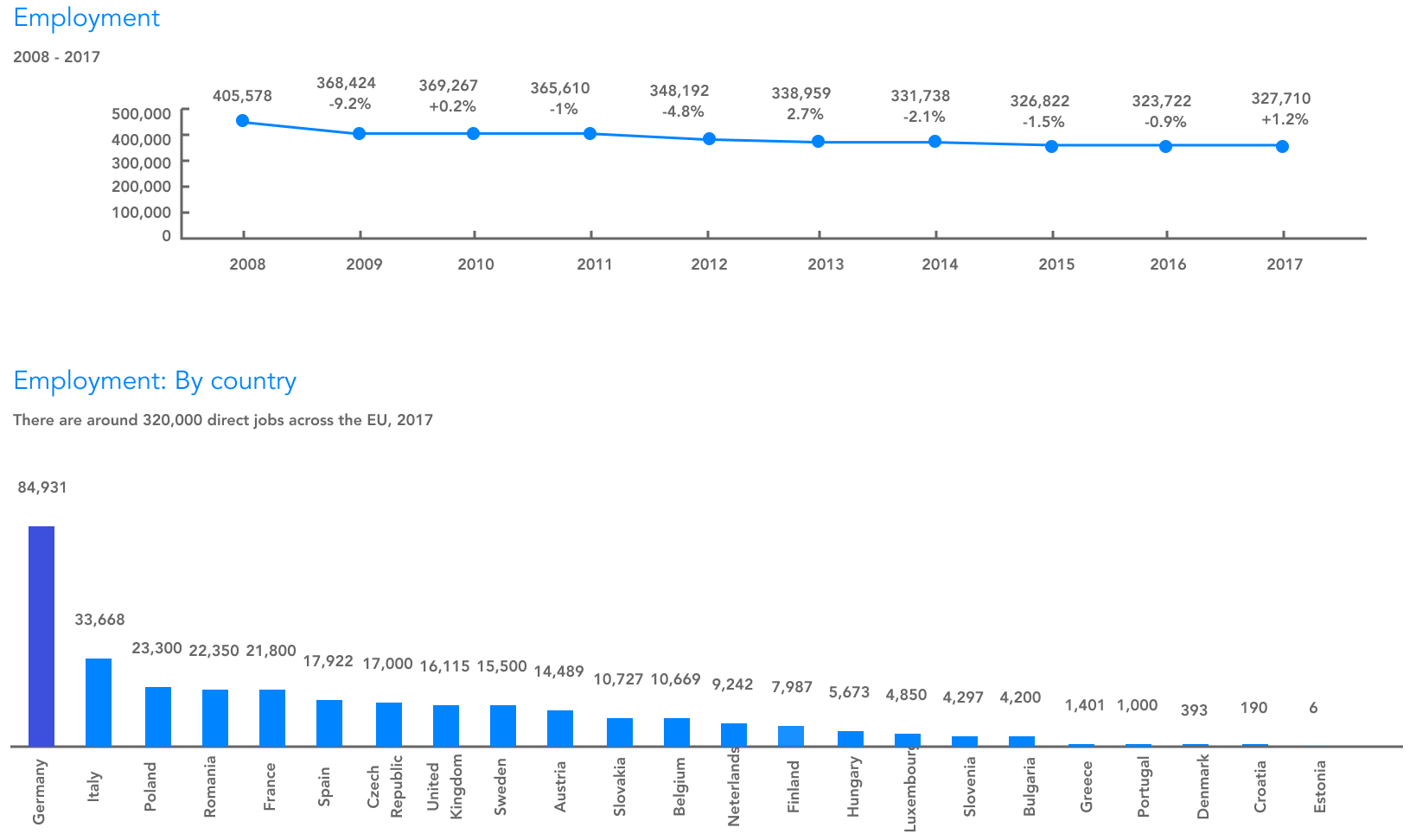

Direct employment of the steel industry is declining

7.4. Exhibit 6. Macroeconomic context of the steel industry in Europe

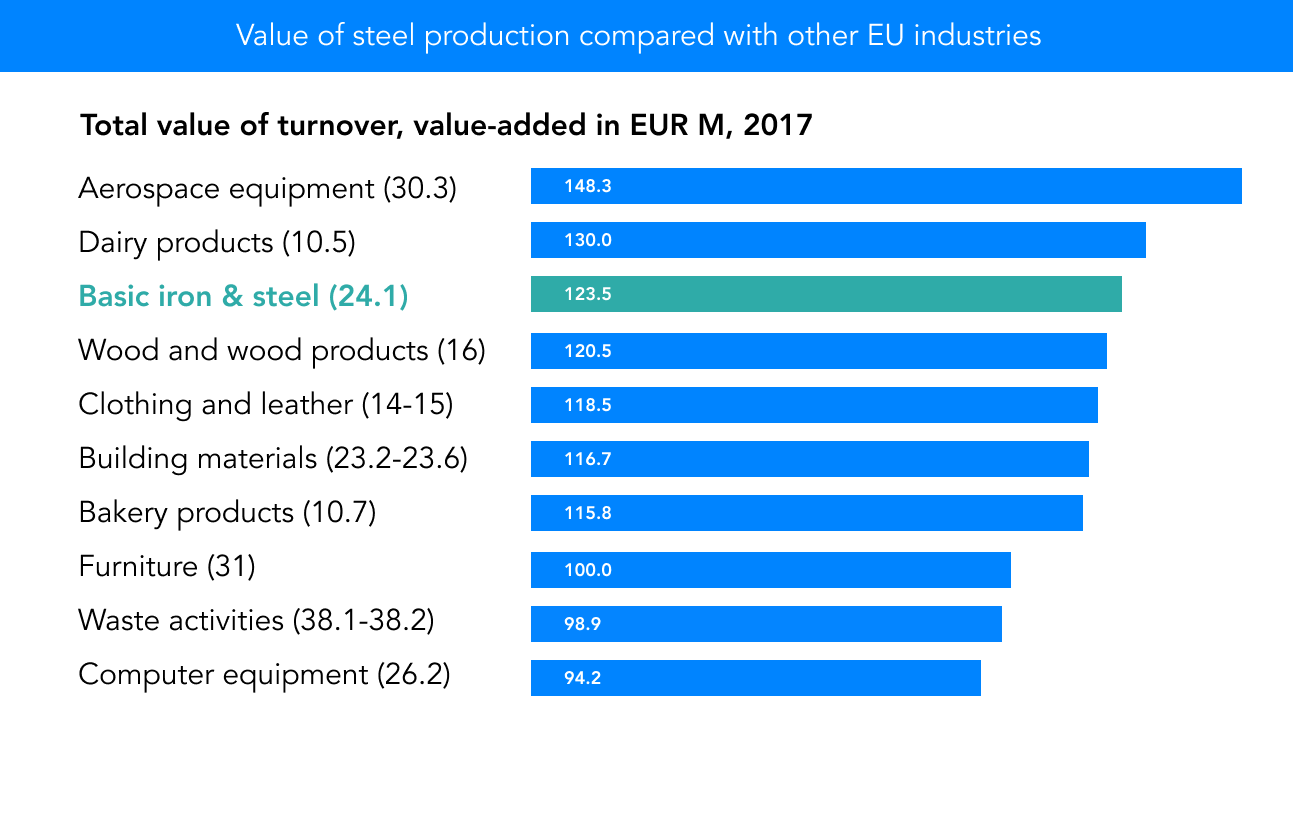

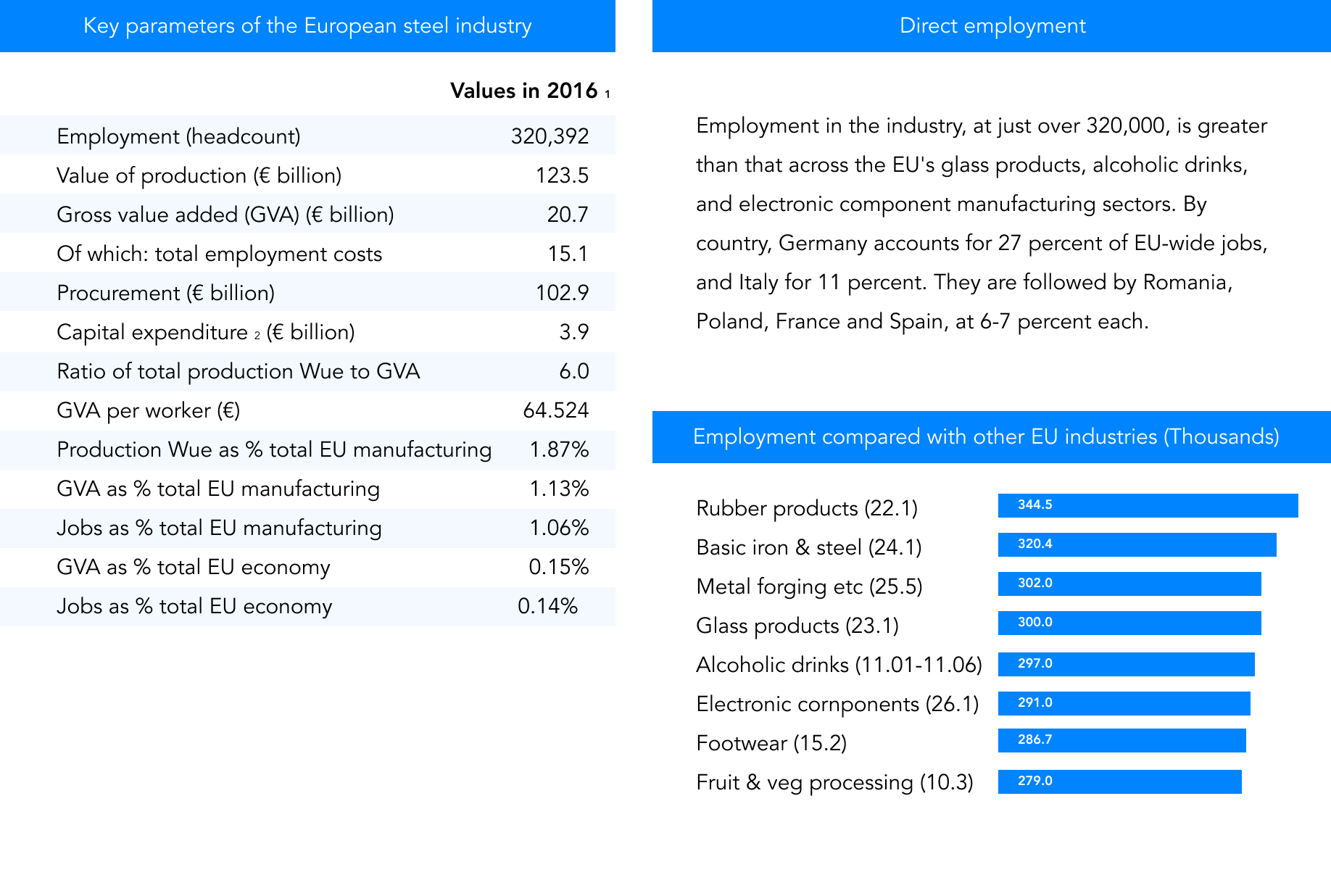

The steel industry is one of the largest contributors to EU manufacturing

EU steel industry direct economic impact

If you have any comments or questions, please feel free to Contact Us.