Preface

Background and objectives

This case study is a part of a compendium of ongoing research by the Partnership on AI (PAI) investigating the impact of artificial intelligence (AI) technologies in the workplace. The objective is to illustrate the tradeoffs and challenges associated with the introduction of AI technologies into business processes. Through this series of case studies, we intend to document the different types of AI techniques implemented, as well as discuss the real-world impacts of AI on labor, the economy, and society broadly. Researchers often struggle to understand the economic and social consequences of AI and its wide-ranging implications for society. For instance, contemporary economists grapple with the question of why ongoing AI and broader digitization efforts have not yet produced clearly measurable productivity gains for the global economy.1 At the same time, one major question for the public and policymakers has been AI’s impact on the workforce, both in the changing nature of work and net job loss or creation. Our hope is to help ground the conversations around productivity and workforce impact in examples of real-world AI implementation while highlighting nuances across sectors, geographies, and type of AI techniques used. This case study specifically looks at the implementation of a conversational banking assistant (AI Chatbot), called Axis Aha! by Axis bank in India, in its customer service automation initiatives.

Methodology

Subject organizations were recruited from a pool of 100+ candidates that ‘AI, Labor, and the Economy’ working group members submitted to the case-study project team. The final set of organizations prioritized for study reflects a combination of their willingness to participate in the project and the intention to profile organizations varying in size, geography, and industry sector. The following case study was developed over the course of about three months in the fall of 2018. The methodology included interviews with a set of stakeholders at Axis Bank who were directly involved in the implementation of Axis Aha! Chatbot. The interview subjects included management in the Digital Banking team at Axis Bank, leadership from Active.AI (the technology vendor that developed the AI Chatbot), and leadership from the bank’s Retail Banking Customer Service team. Interview findings were verified in consultation with independent industry experts. Given access constraints, interviews did not include stakeholders from the third-party customer service vendor with whom Axis Bank partnered. As a result, the case study primarily reflects managerial perspectives and limited industry insights. Representatives from non-profit and for-profit organizations affiliated with the Partnership on AI’s Working Group on “AI, Labor, and the Economy” supported the case study development by conducting interviews, drafting write-ups, and supplementing the case with external research or expert consultations on industry or macroeconomic dynamics. Though Axis bank developed and implemented the chatbot as part of a larger suite of automation technologies, in our interviews, we focused predominantly on the AI Chatbot.

Definition of terms

While we acknowledge that there is no consensus on the definition of terms such as AI and automation, we would like to explain how these terms are used in the compendium:

Artificial intelligence/AI is a notoriously nebulous term. Following the Stanford 100 Year Study on Artificial Intelligence, we embrace a broad and evolving definition of AI. As Nils J. Nilsson has articulated, artificial intelligence is that activity devoted to making machines intelligent, and intelligence is that quality that enables an entity to function appropriately and with foresight in its environment (Nils J. Nilsson, The Quest for Artificial Intelligence: A History of Ideas and Achievements, Cambridge, UK: Cambridge University Press, 2010).

Our definition of automation is based on the classic human-factors engineering definition put forward by Parasuraman, Sheridan, and Wickens in 2000: https://ieeexplore.ieee.org/document/844354. Here, automation refers to the full or partial replacement of a function previously carried out by a human operator.2 Following that definition, levels of automation also exist on a spectrum, ranging from simple automation requiring manual input to a high level of automation requiring little to no human intervention in the context of a defined activity.

Explainable AI or Explainability is an emerging area of interest in communities ranging from DARPA to criminal justice advocates. Broadly, the terms refer to a system that has not been “black-boxed,” but rather produces outputs that are interpretable, legible, transparent, or otherwise explainable to some set of stakeholders.

In this compendium, a model refers to a simplified representation of formalized relations between economic, engineering, manufacturing, social, or other types of situations and natural phenomena, simulated with the help of a computer system.

Productivity: Though productivity and productivity gain can be measured in many different ways, in general, productivity is defined as a ratio of outputs over inputs, which we analyzed in the context of Axis Bank’s outsourced customer service operations across email service, phone service (via a call center), chat service (manual and AI), and Self-Serve Q&A Platform. We used a measurement of output defined by the volume of total (manual + automated) customer service inquiries and input defined as staffing, and analyzed how that ratio changed over time. A more precise measure would be hours worked, but we were unable to obtain this information.

Containment rate: Containment scores at Axis Bank are defined as the percent of customers who are able to get the answer or resolution desired within a given customer-service channel or get a referral within that channel to the correct answer.

Interactive Voice Response (IVR): IVR is an automated, voice-based system that allows customers to receive information on products or services and navigate within a call-center customer service channel.

Customer service inquiries and channels refer to remote help and not to in-person branch visits.

AI techniques underlying the AI Chatbot

AI techniques used in the development and implementation of Axis Aha! (also called the AI Chatbot) included natural language processing (NLP)/natural language understanding (NLU) and natural language generation (NLG), as well as neural networks to extract information from unstructured text to determine a user’s intent, select an appropriate action, and respond in a language the user understands.

1. Introduction

In late 2016 and early 2017, Axis Bank sought ways to introduce scalable and cost-efficient customer service solutions to enable its rapid customer growth. The Digital Banking team at Axis Bank evaluated many options, including whether an AI Chatbot could enable quality, scalable, and cost-efficient customer service in the digital era. A wave of automation and digitization across the retail banking industry in India offered potential solutions that could be explored for improving customer service while reducing rapidly growing costs. Axis Bank wanted to find a set of solutions (including possibly a chatbot) for handling its growing volume of customer service inquiries driven by double-digit customer growth year-over-year. In particular, it sought an approach that was more scalable than the traditional alternative of hiring additional customer service personnel.

Derived from “chat robot,” a chatbot is a computer program that conducts conversations with users via text (or sometimes voice) that is increasingly enabled by machine learning and artificial intelligence. Chatbots have gained traction in several industries and contexts, with customer service a prime application. Yet questions remain about how this nascent technology may impact customer service levels, business results, workflows and business processes, employees and the workforce, and broader industries.

“Could we eliminate the friction between customers and us? Could we give faster and much more accurate responses than existing processes? We needed to reduce email volumes and find a cheaper, more sustainable system of customer support.”

Axis Bank Head of Digital Banking and Customer Experience

This case introduces the broad customer service automation initiatives (including the AI Chatbot) Axis Bank undertook, and explores the impact of these initiatives across Axis Bank’s business. It presents Axis Bank’s motivation for launching the broad customer service automation initiatives and building the AI Chatbot (Axis Aha!). It then examines how the AI Chatbot was developed and the implementation challenges Axis Bank faced. Finally, the case presents the impact of the broad customer service automation initiatives on Axis Bank’s business results and productivity, customer service offerings, workforce, and partners.

1.1. Background on Axis Bank

Axis Bank, founded in 1993, is the third-largest private-sector bank in India, with approximately 20 million customers and 18 percent year-over-year customer growth from 2017 to 2018. With over 59,000 employees, Axis Bank is present in over 2,100 cities and towns across India, with a concentration in eight metropolitan areas. The bank offers a spectrum of financial products and services to various customer segments spanning retail, small and medium enterprises, and corporate businesses. Its retail customer base skews toward younger, urban, and technology-engaged individuals. “Investing in the future” has been a key strategic initiative for Axis Bank in recent years, and includes digital transformation efforts to automate and digitize various business processes.

1.2. Digital trends in India and impact on retail banking

The Indian economy, the sixth largest in the world, grew rapidly from 2011 to 2017, with an average annual GDP growth-rate of 7.25 percent3. This significant economic growth also resulted in investment in digitization across the board. Starting in 2015, the government invested $70 billion in a “Digital India” campaign that, among other priority areas, sought to encourage financial inclusion by, for example, allowing new types of lending, requiring universal digital identification, and eliminating 85 percent of the paper currency in the country.

Consumers’ digital engagement also grew rapidly: The country had an estimated 350 million smartphones4, 200 million monthly active WhatsApp users5, and 450 million internet users in 20176. These digital users, many of whom are part of a rapidly growing middle class, are changing the face of commerce: Digitally active consumers bought about four times as many products as non-digitally active consumers over the past 12 months7.

Indian retail banks are capitalizing on this digital engagement, which is particularly strong among younger, high-growth customer groups. Digital banking penetration in India has grown from 18 percent in 2014 to 56 percent of banking customers in 20178, led by a rapid adoption of mobile banking solutions. Banks, meanwhile, are leveraging automation, new technologies, and customer self-service to expand and improve offerings while reducing costs. Many banks anticipate substantial savings from digitizing products, including lending, savings, and checking to reduce manual service costs. To this end, chatbots are playing an increasingly important role in India’s banking industry. Several of Axis Banks’ competitors in the digital space — the State Bank of India, ICICI Bank, and HDFC Bank— developed chatbots in 2017.9

2. Business context

2.1. Axis Bank customer service before the AI Chatbot

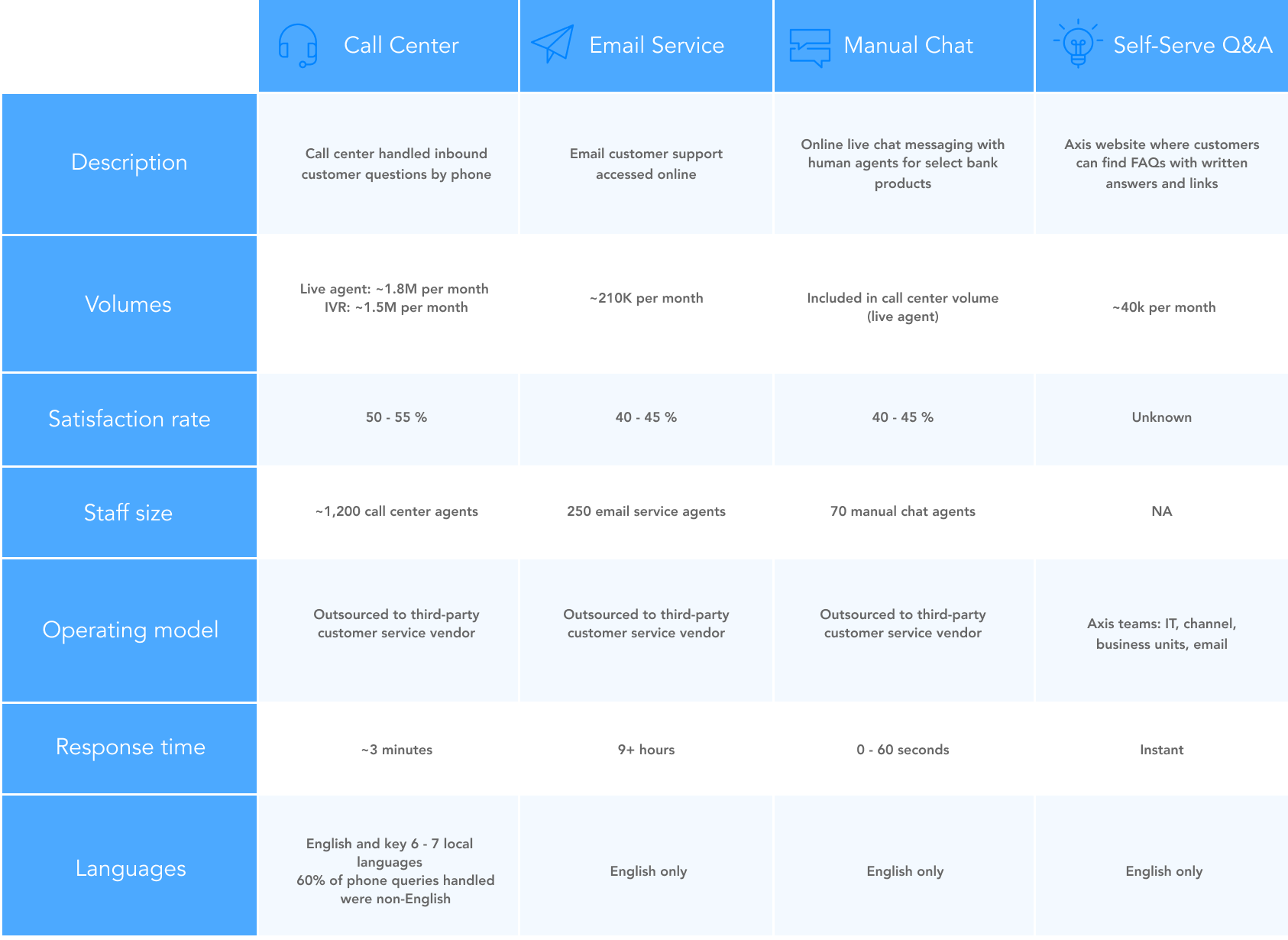

Before introducing its dedicated customer service support portal (comprised of AI Chatbot, Self-Serve Q&A Platform, and Manual Chat) in late 2016, Axis Bank offered a range of human-enabled customer service channels to customers, including in-branch customer service, email service, and phone service (via a call center). More than half of the queries to the Axis call center are in languages other than English, with Axis phone services supporting six to seven of the twenty-two major languages in India.

Around 2015, Axis’s Digital Banking and Retail Bank Operations teams began working with an outsourced customer service vendor to manage its email customer service and call center. The bank began the partnership due to the vendor’s specialization and expertise, and expanded the relationship when it proved valuable in the following years. The same customer service vendor later managed Manual Chat (launched in 2017) on Axis’s behalf.

As of 2017, prior to implementing the AI solutions described in this case, the bank’s customer service achieved industry-average performance: The email service channel had satisfaction scores of 40 to 45 percent as of late 2017. Satisfaction with in-person help at Axis’s roughly 3,700 branches was higher, with 60 to 65 percent customer satisfaction scores during the same timeframe.10 Axis Bank’s legacy email and call center services served about 20 million customers at this time and supported inquiries across all products and features. (For the purpose of this case study, customer service inquiries and channels refer to remote help and not to in-person branch visits, which generally scored more satisfactorily.)

Responding to customers’ desire for more service options and as part of a broader effort to improve Axis Bank’s customer service, Axis commenced a series of initiatives toward two broad objectives: the reduction of overall complaints and an instantaneous self-serve model. Toward these ends, Axis Bank launched Axis Support in late 2016, a dedicated customer service portal that not only provided detailed answers on various problems but also helped to resolve frequent transaction types, such as checking account balance or blocking a debit card’s transactions.11 The Manual Chat function also offered customers live customer service support via instant message for select banking products. This customer service channel had 40 to 45 percent satisfaction scores, similar to the email service channel.

The following diagram lists Axis Bank’s customer service channels (excluding the branch options) and key operating metrics as of late 2017, prior to the AI Chatbot launch. Comprehensive comparative information on the same metrics will be presented later throughout the case.

Select Axis Bank customer service channels (as of Q4 2017)

2.2. Challenges facing Axis Bank’s customer service

With its rapidly growing customer base, Axis Bank’s Digital Banking team was under pressure to find more scalable and cost-efficient ways to improve customer service. A few key challenges the bank faced were:

- Customer service costs were rising, driven by rapid growth and expanding product lines. Customer email and call-center query volumes were rising, driven by the 18 percent per year customer growth from 2017 to 2018. Axis Bank had also expanded its product and service offerings, contributing to the service volume growth as customers navigated a greater number of products and services. To reduce the number of basic customer inquiries addressed by staff at branches, Axis Bank worked to move these customer inquiries to online services. It also added tablet computers and self-service kiosks in branches, allowing it to better field customer inquiries and to reduce the square footage of its newer branches.

- Axis Bank’s customer service model did not allow economies of scale. To keep up with customer growth, Axis would have to double its service agent headcount in the next four years. Not doing so would risk quality of customer service and satisfaction levels, given the current customer service model.

- Management believed that email customer service had room for improvement. Customer satisfaction scores for the email service channel were around 40 to 45 percent and needed improvement. In addition, Axis Bank also received large volumes of customer complaints about the email channel and wanted to address this growing concern. One key reason was longer-than-expected response times for Axis’s email service12. Additionally, resolving an issue could require three to five email exchanges between the customer and email service agent and could take up to four days. Discerning customers’ emotions was also difficult over email, potentially impacting customer service scores and complaint volumes.

2.3. New customer service offerings and move to automation

Axis Bank management had two overarching objectives when building automation into its customer service pipeline: 1) address the growing customer service volumes through new automated customer service channels and 2) reduce customer complaints through improved customer satisfaction. To address these two objectives, Axis Bank launched an additional customer service channel: Its AI Chatbot solution, named “Axis Aha!” In concert with this primary usage of AI, Axis also made improvements to its existing Interactive Voice Response (IVR) at its call centers in 2017 and 2018.13

Axis Bank’s long-term vision is to create an integrated ecosystem in which customers move seamlessly between multiple support channels. This would satisfy customers’ desire for diverse service options, while also gleaning learnings from individual customer service channels that can trigger improvements across the whole ecosystem.

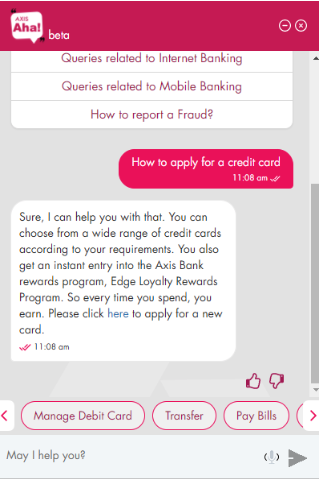

At first, in the fall of 2017, Axis Aha! was an English-only web-based chatbot on the Axis Support page. Customers could ask questions in natural language via text or voice and get instant answers via text response. The chatbot provided contextually relevant responses and enabled customers to complete certain core banking transactions on their own that previously required a customer service agent. Axis Aha! also suggested related questions and topics that customers might find helpful.

As of the next June (2018), the set of possible transactions for Axis Aha! included allowing customers to transfer funds, order checkbooks, pay bills, fund prepaid cards, or block transactions on existing cards. Upcoming features include setting or resetting the PIN for a card, changing a card’s credit limit, downloading a statement, or applying for a loan or card. The chatbot could also help customers with questions or complaints about Axis Bank’s products and services.

As of this writing, Axis Aha! is still in its initial phase of integration within Axis Bank’s broader customer service ecosystem. For instance, if the chatbot is unable to answer a question, it states its limits: “Apologies! I am here to help you on the following banking requests currently…” The AI Chatbot also offers contact information for other support channels when the chatbot cannot offer sufficient help.

3. AI Chatbot as part of the broader customer service ecosystem

3.1. Axis Bank’s decision to implement the AI Chatbot

Consistent with Axis Bank’s broader objectives in launching the new customer service channels, the decision to implement the AI Chatbot stemmed from two beliefs: that automating high-volume, low-complexity customer service inquiries could reduce costs; and that a chatbot had the potential to do this while appealing to key demographics with better service.

Axis Bank executives knew that basic banking tasks — such as checking account balances, receiving information about certain banking products and services, transferring funds, or ordering checkbooks — made up a large portion of customers’ banking needs. Yet customers had trouble getting answers to their questions about these tasks within their existing channels. Offering these tasks through the suite of automated tools presented significant potential for reducing the bank’s growing customer service costs at its service vendor. Given Axis Bank’s relatively urban and digital customer base, a chatbot could also help target its core customers and tap into industry growth trends.

Answers to high-volume and low complexity questions were automatable with a chatbot because service interactions were already highly scripted:

To develop the AI Chatbot, Axis Bank hired a third-party developer. Development and implementation began in the fall of 2017.

“If we are taking humans, giving them scripts, and making them behave like machines, script after script, then let’s actually have intelligent machines answer queries in the first place!”

Axis Bank Head of Digital Banking and Customer Experience

To develop the AI Chatbot, Axis Bank hired a third-party developer. Development and implementation began in the fall of 2017.

3.2. Challenges in AI Chatbot implementation

3.2.1. Chatbot development and training

To train the AI Chatbot, the development team needed data from past customer interactions. Gathering training data of sufficient quality was a challenge because customer chats were unstructured and often included many scenarios that were not covered by Axis Bank’s existing services. To generate training data, therefore, Axis Bank had its employees test the AI Chatbot while ‘pretending’ to be customers.

The specialized language of banking presented an additional challenge. Options for open-source natural language processing did not always correctly interpret banking customers’ questions. For example, according to Axis Bank’s Head of Digital Banking and Customer Experience, “if a customer wrote ‘send 100 next week’, the algorithms didn’t understand: 100 what? Does ‘next week’ mean Monday or Tuesday?” To overcome this challenge, the outsourced developer built bespoke models, and Axis Bank team members wrote out variations of potential customer queries to train the AI Chatbot.

Particularly during early stages of development, the AI Chatbot required constant manual attention, review, and assistance from Axis Bank and its implementation partner; it did not simply learn on its own. The Digital Banking team at Axis conducted manual reviews of the chatbot during each release cycle, and the team also received a weekly list of questions the chatbot could not answer. To aid with responsiveness, team members prepared manual answers to particular questions and included them in the chatbot’s training data. Over time, the Axis team and their partner used process efficiency and automation to reduce manual reviews and increase iteration speeds, though this still required some time and attention.

“Initially it takes a long time, but it’s a bank — there aren’t an infinite number of use cases,” said Axis Bank’s Head of Digital Channels. “After a couple of months, you get a very good sense of how things should be answered.”

A number of development challenges remain for Axis, including those related to seamless handover to customer service agents, integrating data from other channels as training data, and developing ‘micro-bots’ to enhance service in specialized areas. Still, a key hurdle to the successful scalability of the bot is finding ways to provide service in multiple Indian languages. Unfortunately, this process will require manual training for each language. For now, according to Axis Bank, Axis Aha! is responding to queries in English that largely would have come to email support before the chatbot implementation. For Axis Aha! to begin significantly taking on queries that would have come to the call center, training in languages spoken in India is key, as 60 percent of these are not English. (Axis phone services support six to seven of the twenty-two major languages spoken in India.) Depending on the ability of the AI Chatbot to function in multiple Indian languages, the call center may thus never be fully replaced by the AI Chatbot.

“It’s like a child. You have to keep investing, or it will surely die. The learning process for the bot is ongoing.”

Axis Bank Head of Digital Banking and Customer Experience

3.2.2. Risk management, regulatory compliance, and controls

According to Axis Bank, they needed to vet the accuracy and reliability of the AI Chatbot, but often were not able to evaluate the algorithms in-house. To address this challenge, Axis brought in a network of vendors ranging from advisory firms to ethical hackers14 to test the chatbot for vulnerabilities and to certify the algorithms – a challenging process that required a significant amount of documentation, particularly around status updates on development, performance, stress testing, and reviews. Because the algorithms’ explainability, testability, and understandability were low for non-experts, it was hoped that validation from third-party experts would add credibility to Axis’s systems.

Axis Bank also had to be certain that the AI Chatbot would meet regulatory and consumer protection standards. To comply with domestic financial data regulations, Axis Aha! was hosted on-premise and built directly into the bank’s IT infrastructure behind its firewall, keeping all consumer data within the bank. The bank also launched compliance features, such as consumer fraud reporting, early on, and it limited the transactions that could take place via the AI Chatbot: Only certain queries were available, and only a certain amount of money could be sent via wire transfer. This made it easier, for example, to detect suspicious activity, since it required many transactions to move significant funds. To build trust with local regulators, Axis reports that it actively shared details of its AI Chatbot technology, security features, and stress test results.

3.2.3. Stakeholder management

The AI Chatbot had to meet the expectations of both Axis Bank’s customers and its executives. To encourage adoption, Axis Bank emphasized consumer education early on and actively addressed consumers’ preferences and interactions with the chatbot. For instance, because voice enabled chatbots were a relatively new way of interacting, the bank used behavioral nudges such as contests, including one in which customers who ordered checkbooks through the AI Chatbot received special rewards.

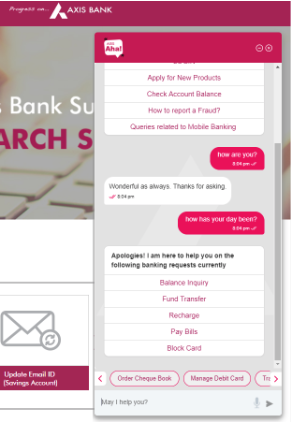

From a belief this would build customer trust, Axis also trained the AI Chatbot to demonstrate empathy and make small talk. For instance, Axis’s partner built a sentiment analysis module that identified basic user sentiments and determined appropriate empathetic responses, as well as a small talk module that allowed the chatbot to exchange pleasantries with users.

The Axis team discovered early on that customers did not just want instructions on how to do transactions; they wanted the chatbot to complete the transactions. “After launch, we realized customers were not interested in finding out the ways to order a checkbook — they wanted the chatbot to actually place the order,” said Axis Bank’s Head of Digital Banking and Customer Experience. “We were initially expecting questions about banking features. What customers asked was completely different. They wanted to do much more with the chatbot, such as checking the status of a past order or complaint they had made. So, we improved the chatbot.”

Customers were not the only ones with high expectations; Axis Bank’s executives wanted quick results. A first pilot test showed the AI Chatbot not performing at a level that would be acceptable for permanent public use. At launch, Axis Aha! achieved a containment rate of 51 percent (percentage of queries that are resolved without going to a human), which was significantly lower than the aspirational levels of above 90 percent containment rates. Support for the project grew, however, as later iterations performed better. In May 2018, Axis Aha! was fully launched to all Axis Bank customers. As of June 2018, according to Axis Bank, Axis Aha! had achieved containment scores of over 90 percent for banking related queries.

4. Development of AI Chatbot

4.1. Teams involved

Because Axis Bank did not have advanced AI knowledge in-house, it partnered with a technology vendor to help build the AI Chatbot, Axis Aha!

The partner team of about 40 people — about 25 developers and 15 support staff — developed and trained the chatbot. Indeed, the entire partner’s staff was fully dedicated to the Axis Aha! project for six months; at the time, Axis Bank was the partner’s first and only customer.

Within Axis Bank, the Digital Banking team managed the overall effort. Two Digital Banking full-time equivalents (FTEs15) were redeployed to provide analysis and support for the chatbot during the initial web launch. As mentioned previously, the Axis Digital Banking team also wrote responses to questions the chatbot was unable to answer to provide new training data. When Axis Aha! launches on mobile, Axis Bank plans to deploy two more FTEs to provide further analysis and support, creating new long-term jobs.

The Axis Bank IT team managed the infrastructure for Axis Aha!, which involved new assignments for one or two of the team’s FTEs. Axis Bank’s business units responsible for products and services, such as credit cards, payments, and checking accounts, also co-created the design of user interactions with the chatbot for their respective banking products.

Finally, as discussed earlier, a range of external partners, including advisory firms and ethical hackers, helped to stress test and validate the chatbot, creating short-term business.

4.2. Development roadmap

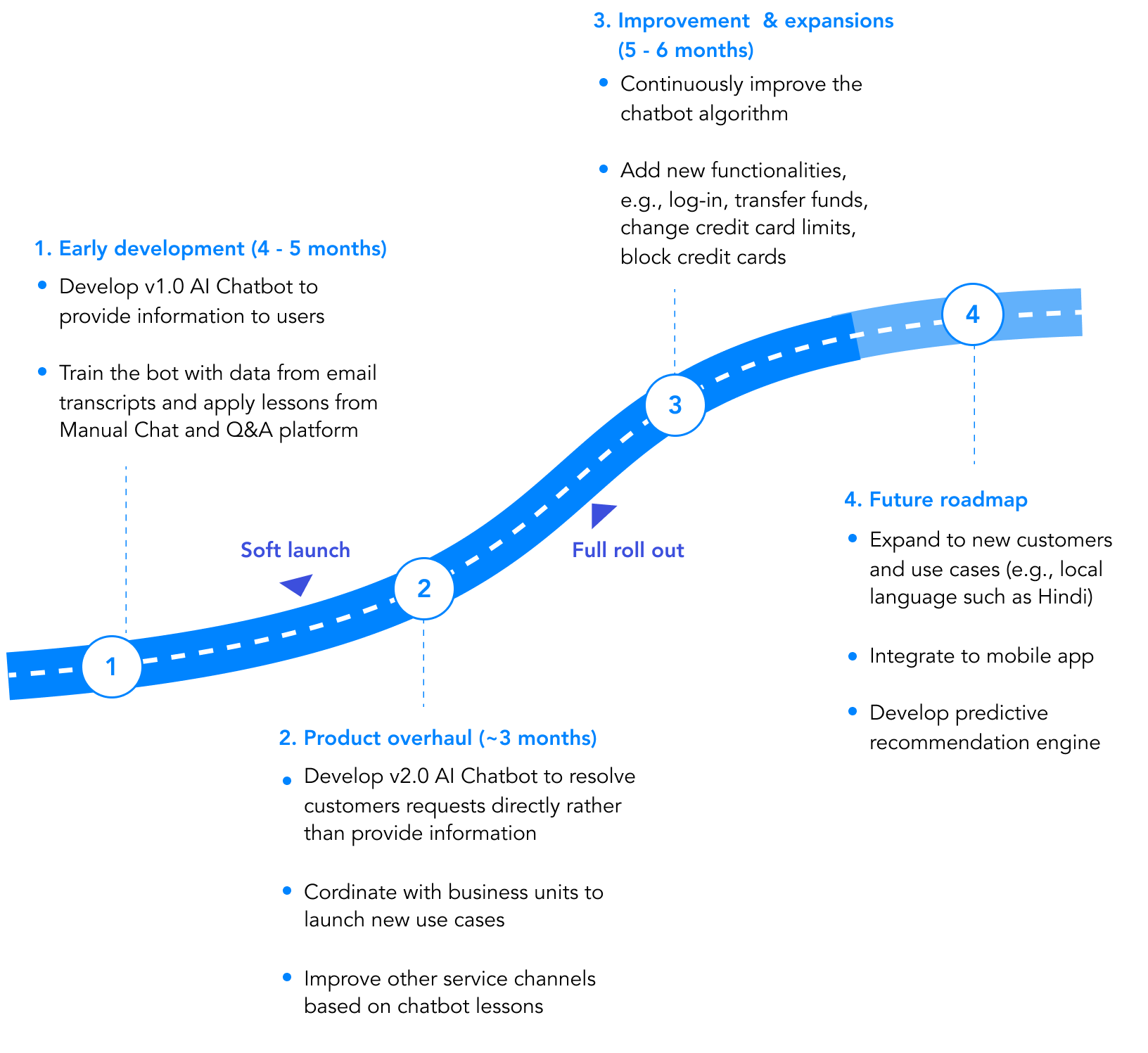

Axis Aha! was built in three phases. It evolved from providing information about banking products and features to allowing customers to act on individual banking needs.

Axis Aha! was built in three ongoing phases

1. Early development

In April 2017, Axis signed a partnership agreement with its partner to develop the AI Chatbot called Axis Aha!. About four months of development, which began later in 2017, were required prior to the initial soft launch. To define initial use cases, Axis Bank analyzed the top searches made by customers on its Self-Serve Q&A Platform, as well as frequent customer interactions on conventional customer support channels. Development focused on addressing high-volume, low-complexity use cases, such as product information queries.

2. Product overhaul

In December 2017, Axis launched the first public pilot test of Axis Aha!, which went live for four hours and achieved containment scores of 51 percent.

Customers often did not behave as expected: More than half of the inquiries during the soft launch were requesting answers about the status of customers’ personal banking actions (such as requesting a checkbook) or needing to resolve an active banking issue, rather than simply asking for information (the chatbot’s initial purpose). In response to these goals, Axis required three to four months of further development to allow customers to resolve issues and take action.

3. Improvements and expansions

After the soft launch in December 2017, during which the AI Chatbot stayed live for four hours, the team redoubled its efforts to add new features and improve the chatbot’s response accuracy. Prior to full release, the chatbot gained additional functionalities, such as transferring funds, changing credit card limits, and blocking debit cards. In May 2018, Axis Aha! was fully launched to all Axis Bank customers.

4. Future product roadmap

Axis Bank is continuing to improve its AI Chatbot with new use cases and performance improvements:

- Integration into mobile banking

- Service in new languages (e.g., Hindi)

- Seamless handover to human-enabled channels (Manual Chat and call center agents)

- Predictive banking recommendations for customers

- Use of customer service data from other channels (e.g., Manual Chat) as additional training data

- Use of “micro-bots” — bots that are restricted to handling a very narrow domain — inside the main chatbot to enhance its performance in specialized areas such as home loans

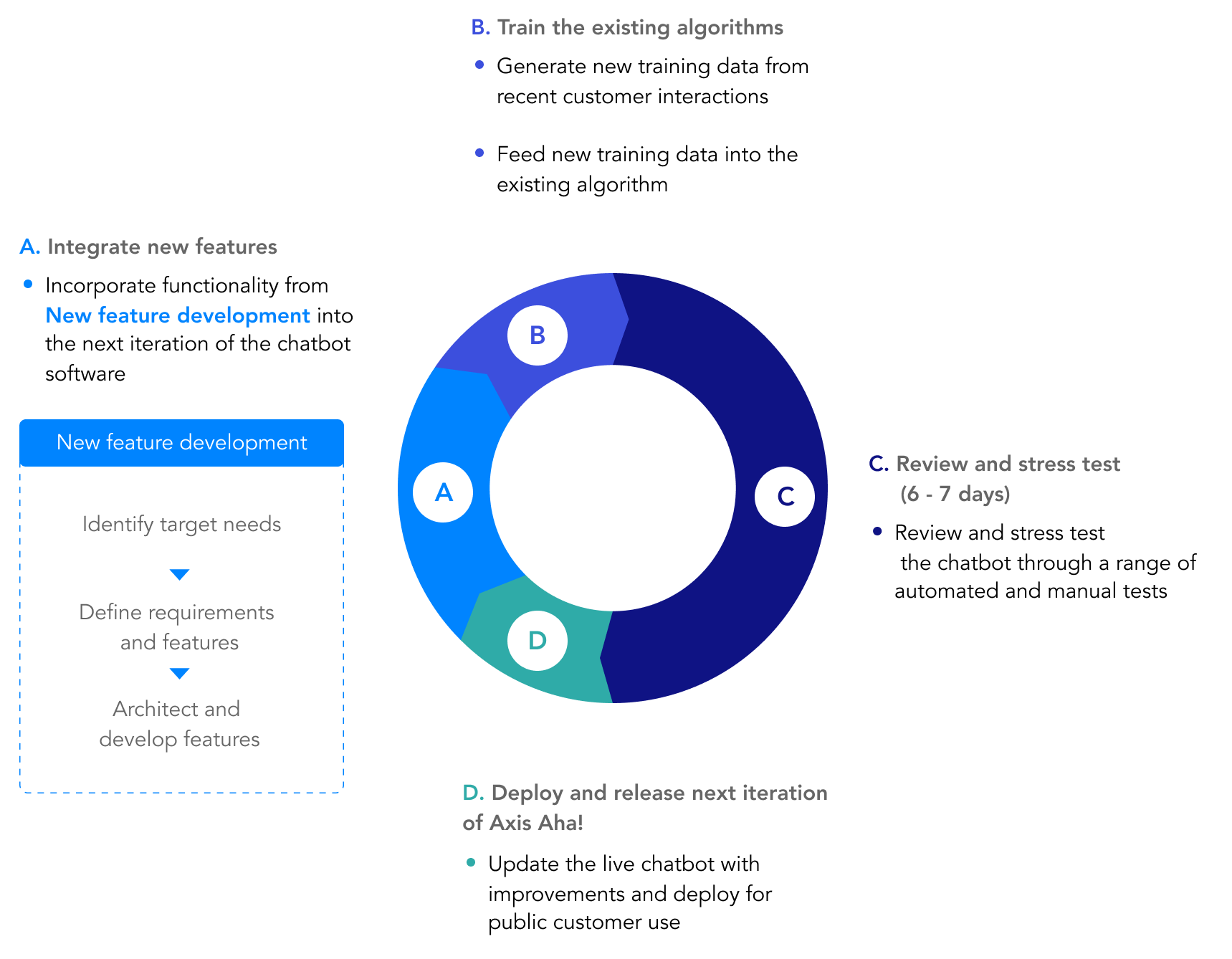

4.3. Iteration and release cycle

After the initial launch in December 2017, the AI Chatbot was updated in release cycles that added new features and improved the algorithms’ performance. Over time, the release cycles decreased from one month to about 15 days because of higher process efficiency and testing automation. The release cycle had four components:

Iteration and release cycle

- Integrate new features: New features are incorporated into regular releases of the chatbot whenever they are ready.

- Train the existing algorithms: Axis Bank and its partner generate new training data from recent customer interactions and Axis Bank documents. These materials are turned into training data by the AI Chatbot to drive improvements in its algorithms.

- Review and stress test: Before a new version of the chatbot is deployed, its architecture and technical execution are reviewed for errors. The chatbot is also tested (using both automated and human tests) to make sure no errors have been introduced and that the chatbot has not learned any “bad lessons” from ambiguous or negative customer behavior. An example error might be responding to “Show my balance” by displaying an FAQ rather than the customer’s balance.

- Deploy and release the next iteration: The live chatbot is updated with latest improvements and deployed for public use.

4.4. Technical development details

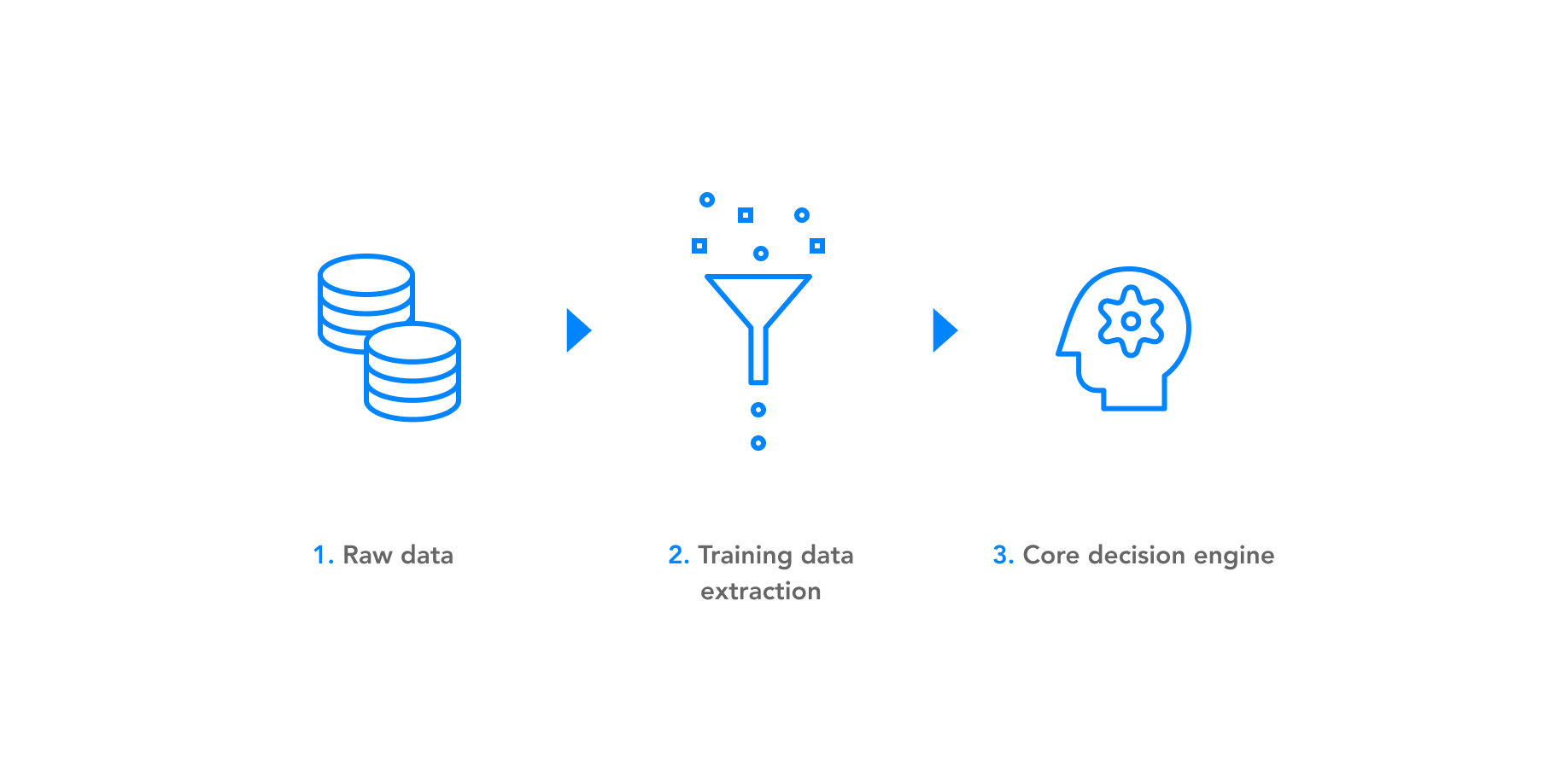

Developing the AI Chatbot required attention to three major areas: preparing the raw data, interpreting and extracting the training data, and developing the core decision engine.

Axis and its partner used a range of machine learning techniques and rules-based systems in each key step of developing the AI Chatbot.

1. Preparing the raw data

Training the AI Chatbot required large volumes of data — such as interaction examples the chatbot has had or will have with customers.

Axis Bank and its partner generated training data from a number of sources: transcripts of customer service emails from Axis Bank; the partner’s proprietary training data on banking interactions; customer search data on the Self-Serve Q&A Platform and responses available on the Self-Serve Q&A Platform; answers to banking questions written by Axis Bank’s Digital Banking team; and Axis Bank’s banking documents and materials, including product, process, pricing, and policy information. Manual Chat and live phone transcripts have not yet been used as a training data for the AI Chatbot.

2. Training data extraction

Machine comprehension and deep learning techniques were used to interpret the training data for the AI Chatbot.

NLP16 was used for classification, detection, and entity extraction – determining whether certain important keywords were being used and honing in on these. NLU17 was used for in-depth data extraction from customer interactions such as tense, semantic parse, and roles. Deep learning (neural networks) extracted data from raw files (such as chat history and banking documents), then clustered and summarized the data for interpretation by the chatbot.

All training data was supervised — that is, given at least some manual review or intervention from the development team. Axis reports, however, that this process was largely automated at a later stage with patent-pending proprietary deep learning modules that the project team used to accelerate chatbot review cycles. Members of Axis Bank’s Digital Banking team also helped the AI Chatbot understand customer intent by writing expert interpretations of what customer requests meant so as to guide the AI Chatbot’s initial learning.

3. Core decision engine

Axis Aha!’s core decision engine leveraged both machine learning and rules-based techniques.

Axis used a range of advanced AI techniques to train the chatbot to understand and respond to customers’ needs. NLP incorporated classification, detection, and entity extraction. NLU narrowed the chatbot response from a range of possible options based on the users’ intent. NLG was used to generate the chatbot response to a customer inquiry.18 A Sentiment Analysis Module was used for assessing a customer’s emotional state in addition to informing the selection of chatbot responses.19

Rules-based systems were used to handle queries that were beyond the AI Chatbot’s training. This included giving programmed answers to questions that are outside of the chatbot’s training and referring customers to other service channels when necessary.

Axis used a combination of machine learning and rules-based techniques to enable the chatbot to engage in basic small talk.20 The small talk module was fairly scripted. For example, the chatbot replies to “How are you?” with “Wonderful, as always. Thanks for asking.” The chatbot, however, always leads users to a banking transaction after two or three consecutive small talk messages from users (for further examples, see Appendix.)

5. Observations

5.1. Business impact

The business impact of the AI Chatbot alone is difficult to isolate, as it was rolled out as part of a broader set of customer service automation initiatives, i.e., Self-Serve Q&A Platform launch, as well as improvements to existing Interactive Voice Response (IVR) at the call center. Despite these challenges, in combination with the other customer service automation initiatives, there are key business trends that can be observed.

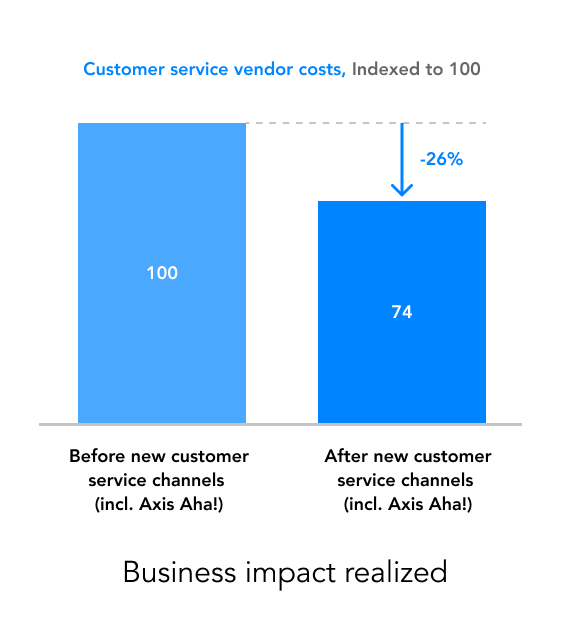

According to Axis Bank, one notable trend is a reduction in customer service costs, as the bank serves a growing number of customer queries: Through the combination of Manual Chat, Self-Serve Q&A Platform, existing IVR systems, and Axis Aha!, costs were reduced by 26 percent year-over-year, while queries grew by 10 percent – a significant increase in efficiency, though Axis Aha! is only one component of this equation.

New customer service automation initiatives, including launch of the AI Chatbot, also had several less-measurable — yet still important — impacts. As a result of these initiatives, customer service volumes began migrating to automated channels (e.g., from email to Axis Aha! and Self-Serve Q&A Platform). Because these channels offer faster service, this migration is expected to improve average customer service scores at Axis Bank, though this has not yet been measured or attributed directly. Axis Bank also gained insights from customers’ interactions with the AI Chatbot that led to product improvements across the bank’s website, such as relocating difficult-to-find web-pages that were often the subject of chat queries.

5.1.1. Cost reductions

Axis Bank reported that introducing the Manual Chat, Self-Serve Q&A Platform, and the AI Chatbot, as well as improvements to the existing IVR system, helped reduce its third-party customer service vendor costs by 26 percent per year, despite being in a period of customer growth of 18 percent annually. Although service volumes on both human-enabled customer service channels (email service and call center) decreased, the cost reduction was primarily driven by a reduction in email customer service agent headcount. The size of the email customer service team went down to about 60 from about 250 Full Time Equivalents (FTEs) – a 76 percent reduction. At the same time, to fully understand the broader impact of the AI Chatbot and other initiatives on customer service costs at Axis Bank, it will be important to take into consideration the associated development and maintenance costs for the new customer service automation initiatives; these currently are not known.

5.1.2. Productivity impact of migration to automated channels

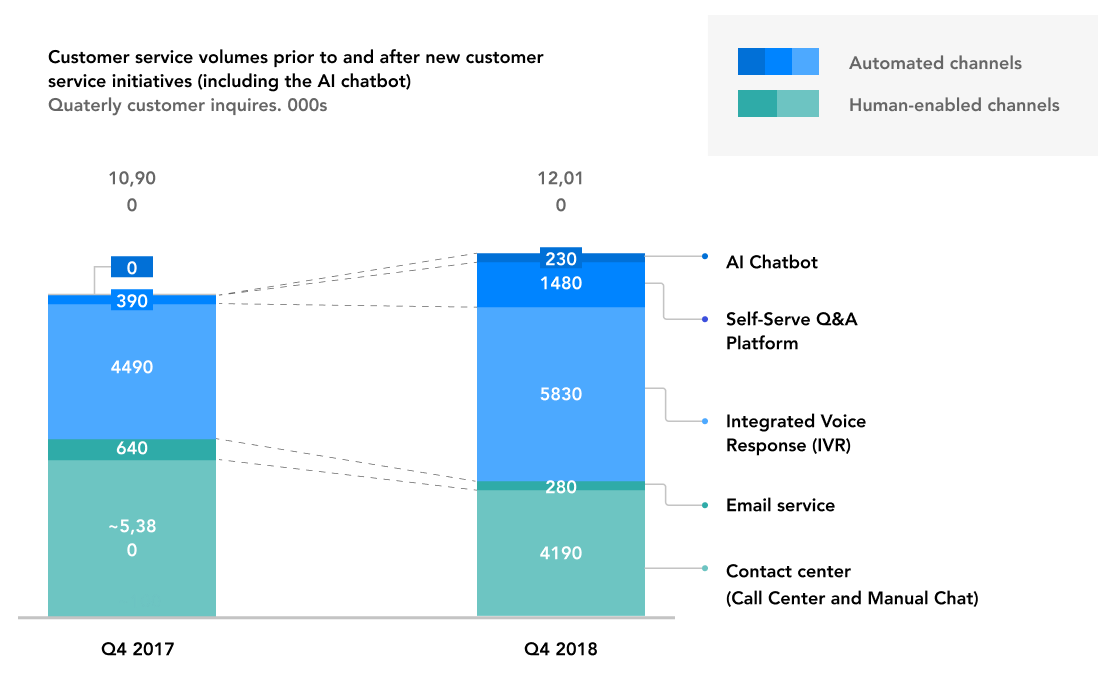

Axis Bank reports it was able to handle its growing customer service volumes with fewer customer service agents, driven by a migration in volumes from human-enabled to automated customer service channels, implying an increase in the labor productivity of the overall customer service function.21 The total customer service inquiries volume increased by 10 percent from Q4-2017 to Q4-2018, while the total size of the vendor customer service workforce decreased by approximately 12.5 percent.22 Axis Bank’s customer service vendor costs, associated with human-enabled channels, also decreased by 26 percent. Service volumes on both human-enabled customer service channels (email service and call center) decreased in the same period, while the volume served by automated channels increased. This migration in existing volumes and the new customer service demand were served by the following automated customer service channels: call center IVR, Self-Serve Q&A Platform and a smaller but growing portion by the AI Chatbot (Axis Aha!) [see exhibit below].

Out of the 2.7 million additional customer service inquiries served by the ‘automated’ channels from Q4-2017 to Q4-2018, only 9 percent were served by the AI Chatbot, as it was only recently launched. However, through increased adoption from Axis Bank customers and introduction of new features and functionalities, Axis Bank expects the quarterly customer service volume on the AI Chatbot to increase to 930,000 unique chats in Q1-2019,23 a four-fold increase compared to Q4-2018.24

Migration of customer service volumes to automated channels also improved customer service quality; namely with respect to time to serve customer service inquiries and the average response time. For example, previously, to request a printout statement, customers had to send an email and wait up to 24 to 48 hours for an agent to trigger the statement. Now, with Axis Aha!, customers can trigger their own printout. Through migration of these basic transactions to more automated channels, Axis reports that its customer service agents have started to manage more complex customer inquiries.

Growing customer volumes have started migrating to automated channels

5.1.3. Customer service quality improvements

As customer service volumes migrate to automated channels, Axis Bank expects overall customer service quality to improve due to improved response times and service hours. The AI Chatbot and Self-Serve Q&A Platform (as well as the non-automated Manual Chat service) provide customers with near-instant responses, whereas email resolutions generally spanned multiple days. In addition, automated customer service channels, the AI Chatbot, Self-Serve Q&A Platform and call center IVR, provide 24/7 service, whereas human-enabled channels are only available during business hours. Although customer satisfaction scores are not measured comprehensively across all automated channels today, Axis Bank reports that 80 percent of users have rated its Self-Serve Q&A content to be relevant and useful, a much higher level than the customer satisfaction scores for human-enabled channels. Increasing the span of customer service channels also gives customers more choices for support. In Axis’s view, this increases the likelihood that customers will have their questions answered in the way that is most convenient for them.

5.1.4. Impact on project prioritization across the bank

Axis Bank gained valuable insights from customer interactions with the AI Chatbot that led to product improvements across Axis Bank’s website. Visibility into customers’ questions to the chatbot offered insights into customers’ concerns — becoming a new source of insight Axis Bank initially did not anticipate.

Axis also used lessons from the AI Chatbot to improve other customer service channels and vice versa. For example, the design of the Self-Serve Q&A Platform was adjusted when the team observed that customers often asked about the status of their debit cards; Axis moved card tracking to a more visible position on the website.

Axis Bank used customer insights from the chatbot to prioritize projects.

“We realized: if it’s important for the bot, maybe it’s important for the bank,”

said the Head of Digital Banking and Customer Experience.

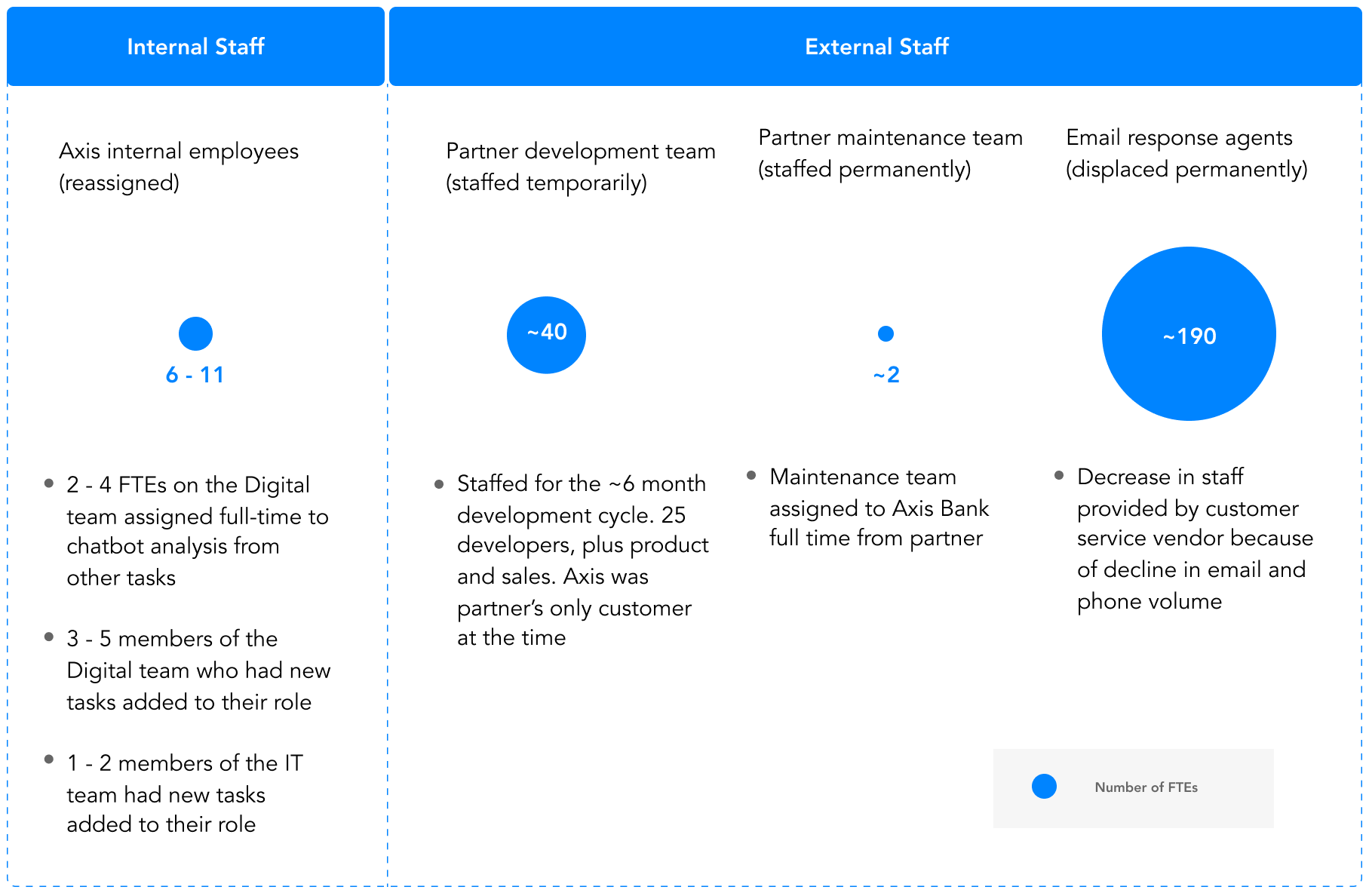

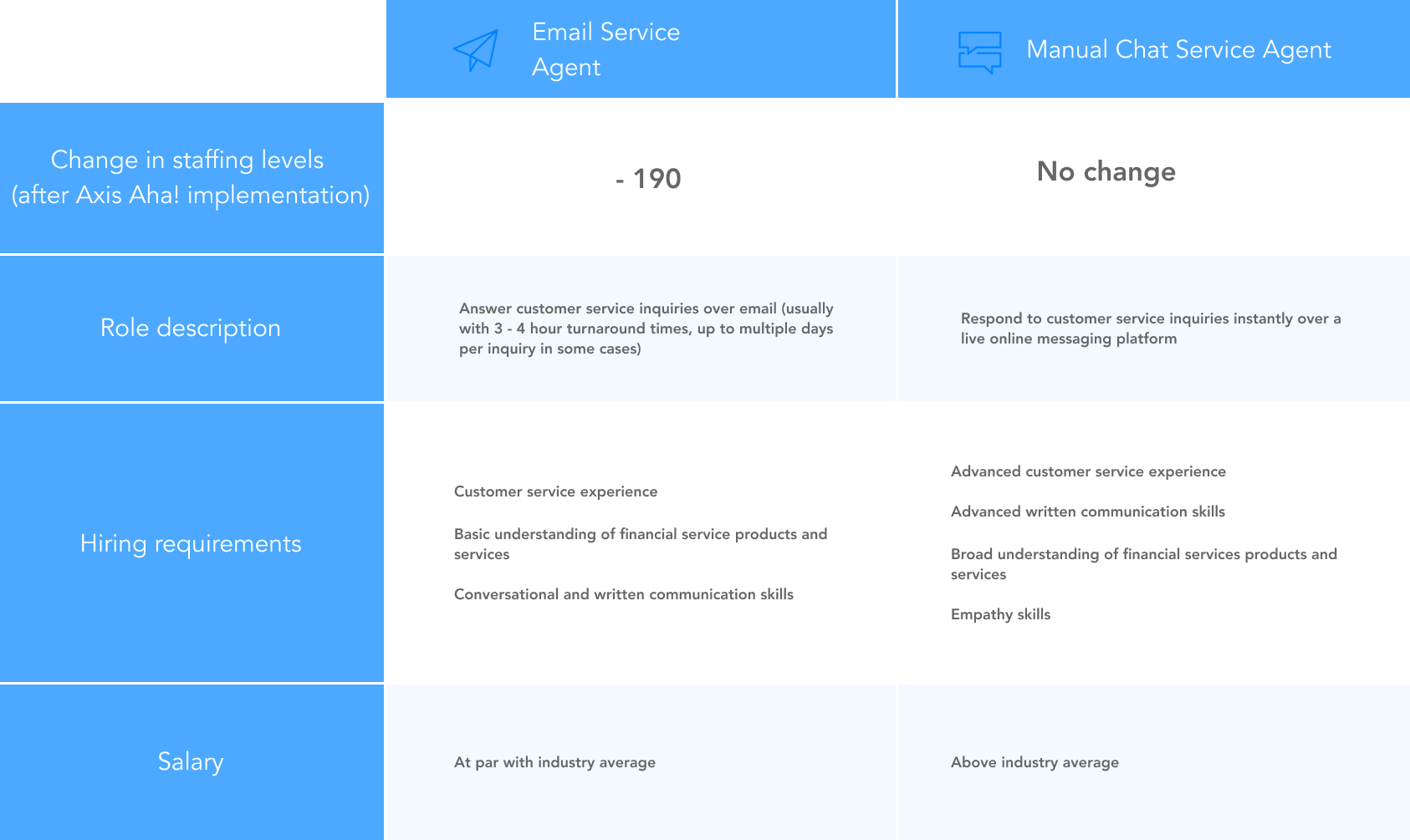

5.2. Workforce impact

The main workforce impact of the new customer service initiatives – introducing the Manual Chat, Self-Serve Q&A Platform, and the AI Chatbot, as well as improvements to the existing IVR system – occurred outside the bank. For instance, Axis’s outsourced email service team was reduced by about 190 FTEs, while more than 40 third-party technical experts gained temporary jobs contributing to Axis’s initial chatbot development. The impact on internal Axis Bank employees, meanwhile, was limited to reassignments and minor changes in daily activities for 6-11 FTEs.

Workforce impact cascaded externally, more than internally, at Axis Bank

5.2.1. Impact on third-party customer service workforce

The customer service agent workforce, primarily the email team, was most directly impacted by the Axis Aha! implementation. While the call center and Manual Chat teams did not experience reductions,25 the number of email customer service agent positions assigned to Axis Bank at the third-party vendor decreased from about 250 to about 60 – a 76 percent decrease in the team size. Axis reports that the displaced email agents were re-deployed by the customer service vendor to other projects, such as elsewhere on the Axis account or moved to other client accounts.

For customer service agents who moved to the Manual Chat team, these positions generally needed skills that differed from the email customer service skills in several ways. First, the agents had to be able to respond to customers’ asks immediately, rather than being able to take a few hours to research an answer and reply. Axis reports that they also needed better, more-empathetic conversational skills. Experience in banking or broadly in the financial sector was also required.

Ongoing advancements in the features of the AI Chatbot (e.g., seamless handover to human channels when needed) will potentially lead to retraining for existing customer service team members (email, call center, and Manual Chat) so that they can best coordinate with the AI Chatbot. According to Axis Bank, these customer service agents are now spending more time on more-complex customer inquiries, as routine questions have migrated to the automated customer channels, including the AI Chatbot. Going forward, more granular data on tasks and required skills for these job types as well as data distinguishing AI-related changes from broader digitization efforts will help in understanding how AI is driving change.

Email staffing levels decreased substantially

5.2.2. Impact on technical vendors and expert partners

Impact of the AI Chatbot alone on customer service related productivity gains and cost savings is difficult to assess. Yet, the AI Chatbot implementation did trigger temporary business gains for third-party vendors, including technology developers, ethical hackers, and advisors. It remains to be seen whether implementing new features will require additional development staff and third-party vendors for vetting and stress-testing the chatbot as it evolves.

Axis Bank was its partner’s first customer, and all 40 people at the company (25 developers and 15 staff in support roles) were fully dedicated to the development of the chatbot for six months. Two people from the partner also received permanent jobs at the partner organization in providing ongoing support and maintenance for the chatbot.

5.2.3. Impact on Axis Bank’s internal employees

The changes to Axis Bank’s internal workforce due to the AI Chatbot were relatively few. Within Axis Bank, job responsibilities for between six and eleven people changed, and many other employees made small contributions of their time to the chatbot testing.

Of the employees whose job responsibilities changed, one or two IT workforce members were trained to support the chatbot; no new hires were made for these tasks. About three Digital Banking team members also changed roles to help manage the AI Chatbot’s impact on customer service and to provide training materials for the AI Chatbot.

The Digital Banking team redeployed two FTEs to monitor and analyze Axis Aha!. In the future, two additional FTEs are expected to join in this function, as Axis Aha!’s mobile launch may increase customers’ use and adoption. Over the long term, however, the team seeks to reduce the “analysis burden” in this work stream and automate the work of analyzing and improving the AI system, through AI as an improvement tool. For example, two FTEs currently analyze the chatbot’s performance and also assess where the chatbot has failed to respond properly; these tasks are expected to be automated by AI eventually, though some human input and oversight may always be needed.

Employees in several other Axis departments played supporting roles in the chatbot development. Business units responsible for products and services (e.g., payments and checking accounts) co-created chatbot experiences involving their domains, including sending payments and requesting a new checkbook through Axis Aha!. Employees across the company also participated in ongoing testing of the chatbot.

6. Reflections and conclusion

6.1. Reflections

6.1.1. Risk management and controls

Developing trust, control, and regulatory compliance for Axis Aha! required third-party experts, a system of AI checks and balances, and regulator-friendly features.

- Axis and its partner actively managed risk by creating multiple testbeds, bringing in expert third-parties to review the code, and reviewing the chatbot’s learnings.

- To avoid regulatory and compliance issues, Axis Bank launched features such as reporting of consumer fraud early on. Axis Aha! was also hosted on-premise within the bank’s own servers due to data localization requirements, though deploying on cloud infrastructure may have offered better performance. To aid transparency, Axis Bank actively shared details of its AI Chatbot technology, its security features, and its stress test results with the local regulators.

- Additionally, Axis limited the range of transactions taking place on the chatbot as another means of preventing and detecting suspicious behavior.

6.1.2. Stakeholder management

Axis Bank proactively educated customers and built functionality to meet expected (and at first unanticipated) customer preferences.

- Axis responded to customers who wanted to solve issues with the chatbot, not merely get information with new program functionalities.

- Axis Bank proactively managed customer adoption through behavioral nudges such as contests and rewards.

6.1.3. AI Chatbot development and challenges

Axis Aha!’s development team employed an iterative development approach through frequent reviews between release cycles.

- Axis Aha! was built in multiple iterations and pivots, rather than in one launch, and continued to be updated in 15-day release cycles. The development cycle times have decreased from one month per cycle to about 15 days over time through increased process efficiency and automation.

- The development team aims to further automate the manual review process and shorten the release cycles. Over time, the manual review can potentially be fully automated leading to much shorter release cycles.

- Rather than launching a fully developed chatbot, Axis Bank saved some features for future development, including the launch of mobile version, availability of other languages (e.g., Hindi), and integrations with other customer service channels to create smooth handoffs to live agents.

Axis Aha! was built using a combination of machine learning and rules-based techniques.

- AI Chatbot’s training data was generated from the bank’s existing customer interactions and banking materials prepared by Axis Bank, in concert with its partner’s pre-trained models, which relied upon other proprietary data.

- Axis Aha! used a combination of NLP for classification, NLU for customer data, and deep learning (neural networks) for extracting and summarizing raw data.26

- Axis Aha!’s core decision engine leveraged both machine learning and rules-based techniques to understand and respond to customers’ needs.27

- Rules-based systems handled queries that were beyond the AI Chatbot’s training, including referring consumers to other customer service channels if the chatbot could not provide satisfactory answers.

Axis Bank overcame numerous development challenges when building the AI Chatbot.

- Teaching the AI Chatbot the language of banking in India required substantial development and manual oversight. Open-source NLP offerings could not handle the language of banking, and customers pose the same questions in many variations. Thus, Axis’s partner built new models from scratch with manual help from Axis Bank to understand customers’ questions.

- Developing the AI Chatbot required generating training data from ongoing customer interactions and Axis Bank’s expertise. Axis Bank used past support interaction transcripts and banking documents, where possible, and had employees write questions and answers for the AI Chatbot, or interact with the bot as if they were customers to generate new data.

- The development team continually adapted to the new learnings from customer interactions. In the initial four-hour launch of the AI Chatbot the development team realized that customers wanted to do much more with the chatbot than simply receive information. Thus, the development team worked on building additional action-taking features and capabilities before re-launching the AI Chatbot in May 2018.

- Training the AI Chatbot required constant manual attention, review, and assistance from Axis Bank and its partner. The Digital Banking team manually reviewed the chatbot and questions it could not answer during each release cycle.

- Axis Bank hopes to provide service in multiple Indian languages, but this will require building new banking semantic layers for the respective languages, and also performing additional manual training. Thus, while the chatbot has largely replaced English-written emails, it is not yet equipped to wholly reduce phone inquiries, 60 percent of which are non-English.

6.1.4. Business and productivity impact

As stated earlier, the business impact of the AI Chatbot alone is difficult to measure, as it was rolled out as part of a broader set of customer service automation initiatives. Yet there are clear trends observed by Axis Bank. In combination with other customer service automation initiatives, the AI Chatbot helped reduce third-party customer service costs by 26 percent per year, while also revealing new customer insights.

- The net reduction in customer service headcount came despite an 18 percent per year customer growth and 10 percent customer service inquiry volume growth during the same period.

- Net service agent headcount decreased because customer service volumes migrated from human-enabled to automated customer service channels.

- Although the AI Chatbot’s contribution to the migration towards automated customer service channels is minor as of Q4-2018, its impact is expected to increase rapidly as customer adoption picks up and the AI Chatbot use cases mature. This migration is expected to improve overall customer service quality, given faster response times and more available hours of service.

- Viewing customers’ unconstrained interactions with the AI Chatbot offered Axis Bank insights into customers’ concerns and priorities.

6.1.5. Workforce impact

Demonstrating that labor effects can cascade to other organizations, the new customer service initiatives, including the AI Chatbot, primarily affected workers outside the banking sector, in the IT and business process outsourcing (BPO) sectors.

- The customer service agent workforce at the third-party vendor experienced the greatest headcount impact (a 76 percent reduction in those assigned to Axis Bank) as a result of the collective set of customer service automation initiatives.

- Multiple technical vendors and partners experienced business gains, leading to temporary job increases (all attributable to the chatbot) during the AI Chatbot implementation.

- Inside Axis Bank, between six and eleven FTEs in IT and Digital Banking teams were given new assignments as a consequence of the chatbot’s development and implementation. Other employees helped with testing. Business units also helped design chatbot interactions in line with customer needs and product specifications.

6.2. Conclusion

Axis Bank’s AI Chatbot illuminates broader industry trends that the booming Indian economy has helped to enable, such as expanding consumer digital engagement. Within Axis Bank, the AI Chatbot is part of a broader trend of customer service initiatives aligned with this expansion. Related initiatives also include the introduction of Self-Serve Q&A Platform and Manual Chat as well as improvements to the existing Interactive Voice Response (IVR) system at its call centers.

The diffusion of AI technologies in the banking sector aligns with the Indian government’s vision of a “Digital India,” in which digital adoption, such as AI technologies, can help people overcome financial access barriers. Yet, as this case study reveals, teaching the chatbot the context of a specific industry takes significant time and resources. Open-source language processing AI offerings were not sufficient for Axis Bank’s needs. Offering the AI Chatbot in multiple other languages, such as in Hindi, would take significantly more development time, meaning the call center, as one Axis executive put it, “may never go away in the Indian context.”

The AI Chatbot implementation, in combination with other customer service initiatives, improved productivity in handling customer service inquiries at Axis Bank. Though productivity gains of AI applications and automation initiatives may not yet be visible in the broader economy, Axis Bank’s case suggests that broader productivity gains are possible, albeit with questions about whether and how quickly productivity gains from automation suites, including AI, could spread in the future with increased diffusion of such technologies.

While the AI Chatbot was launched recently, it has already demonstrated how automation and AI can impact labor productivity. The chatbot was capable of handling thousands of customer inquiry volumes across multiple banking products with 24/7 availability. This automation of customer service tasks contributed to the elimination of about 190 of 250 (outsourced) customer service email agent positions on the Axis account, a 76 percent reduction in team size.

While external labor implications were significant, the AI Chatbot notably did not have major internal implications for Axis Bank. Building an AI Chatbot did not require Axis Bank to invest in hiring AI experts into the bank — rather, it was able to partner with technology vendors to develop the new AI-powered chatbot. The development of the chatbot also prompted regulatory considerations, but not new regulatory frameworks or processes. Axis Bank and its partner actively managed compliance requirements and risks by creating multiple testbeds, bringing in expert third-parties to review the code, and reviewing the AI’s learnings before promoting new behaviors to the public.

In many ways the migration from human-enabled customer service channels to automated ones has consequences for an emerging economy like India’s, with a large working demographic. The specific case of Axis Bank raises questions about the future of the workforce, especially in customer service (see Appendix for expanded further questions for future research). Axis Bank’s use of automation and AI had far greater impact externally than internally on job losses, job gains, and reassignments. Only an estimated 6 to 11 internal FTEs saw their jobs change within the bank. Job displacement occurred principally at Axis Bank’s customer service vendor, whereas job gains were realized in a diverse set of more technical and specialized jobs (e.g., data scientists) within other third-party vendors.

While technical vendors have experienced temporary business gains thus far, ongoing support for the AI Chatbot requires far fewer FTEs. The analysis, testing, and development of AI Chabot iterations are being increasingly automated. Eventually, Axis Aha! may learn to address more complex customer service tasks and ultimately replace Manual Chat agents altogether, or significantly reduce their number. Similarly, if Axis Aha! successfully learns to converse in multiple languages, it may also begin to reduce the number of call center employees. In these ways, we may be seeing only the beginnings of the human-resource impact of these chatbot technologies.

These findings raise a number of questions regarding the broader impact on the workforce and labor market: How will front-line customer service employees be impacted in the medium to long term as deployment of AI chatbots becomes more widespread? Will labor impact remain outside the bank, or will internal implications grow as companies increasingly adopt and integrate AI? If the impacts are externalized, who will take responsibility for the people who are impacted by those externalities? Will banks become more dependent on technology vendors or bring AI expertise in-house? How will the broader IT and BPO sectors be impacted going forward? Further research involving the perspectives of both workers and consumers could be particularly valuable as we collectively come to understand the nature of AI-use in the real world.

7. Appendix

7.1. Key questions for future research

This case raises a number of unresolved questions for further research. Some of these questions pertain specifically to the labor experiences and implications for workers on the ground: How severely will front-line customer service employees (for instance, in-branch support specialists) be impacted in the medium to long term as deployment of AI chatbots becomes more widespread? How will the broader IT and Business Process Outsourcing (BPO) sectors be impacted? Will the labor impacts of AI remain external to banks and other implementing organizations, or will the internal implications grow with time as companies increasingly adopt and integrate AI? If the impacts are externalized, who will take responsibility for the people who are affected by those externalities? Other questions pertain more broadly to the societal outcomes that AI systems might facilitate: Will AI increase financial access by scaling banking services to mobile users, or might it deepen the accessibility gap due to implementation challenges with language translation and unequal access to internet banking? Should consumers be notified when they are interacting conversationally with an automated system? Further research involving the perspectives of both workers and consumers could be particularly valuable as we collectively come to understand the nature of AI-use in the real world.

7.2. Banking chatbots

The growth of messaging services has contributed to the growth and effectiveness of chatbots , which are programs that an individual can talk to through messaging apps, chat windows, or voice. One advantage of these chatbots is that they can provide 24/7 customer service.

7.2.1. Chatbot banking examples

- State Bank of India’s SIA chatbot is designed to handle customer queries and guide customers through retail products and services.

- HDFC Bank’s EVA was launched to provide conversational experience to customers across digital platforms. Customers can access product details, fees, application processes, branch IFSC codes, and other information. In the first months of its deployment, HDFC reports it handled over 3 million queries with an accuracy ratio of 85 percent.28

- ICICI Bank’s iPal offers help on Q&As, paying bills, fund transfers, recharges, and new feature discovery. iPal is integrated with the search feature on the website, and queries are routed to human operators, if needed. ICICI reports that it handled about 1.3 million queries monthly in FY18.29

- SBI, ICICI Bank, and HDFC are the main competitors to Axis Bank in the digital space, and each has implemented a chatbot.

7.3. Axis Aha! interface example

7.4. Axis Aha! small talk example

Each time a customer uses Axis Aha!, it responds with a different greeting that goes beyond “Good morning” or “Good afternoon,” depending on the time of the day or even the day of the week. It also features offers related to the message. For example, for the first five to six days of the month, the morning message would be, “A new month with a new start. Hope you have paid your rent and bills. If not, do it here and now!”

7.5. Key macroeconomic trends

The Indian government has invested $70 billion in its “Digital India” initiative and envisions moving from being a “data poor” country to a “data rich” country in five years. The government is also pushing to transform the financial sector into a digital, inclusive, and interoperable market, with new policies and regulations. For example, in a move toward digitizing currency, about 85 percent of paper currency ceased to be legal tender on November 8, 2016. Most of the adult population has been issued a Unique Identification Authority of India (UIDAI) biometric identity, and a digital platform has been set up to authenticate it. New policies are enabling competition and financial inclusion by allowing new types of lending and identification.

In June 2018, the National Institution for Transforming India, also called NITI Aayog, published a draft National AI Strategy for India, noting the increased use of AI in the form of chatbots in the banking sector and its potential, among other things, to enable financial inclusion.

Meanwhile, India’s growing population is becoming more urban, youthful, and middle-class, and is rapidly adopting mobile, internet, and digital banking. India’s urban population is growing, and 65 percent of the population is under the age of 35.30

Digital banking has grown with mobile use, and there is significant room for future growth. Digital channel usage now represents more than one-third of monthly transactions. Smartphone banking went up four-fold from 2014 to 2017 and reached 54 percent of customers.31

7.6. Recent history of digital at Axis Bank

Digital transformation is a strategic pillar for Axis Bank, with 10 years of ongoing investment and further opportunities for growth.32

Axis Bank reports that these efforts are paying off: According to an analysis for its annual report, Axis was ranked No. 1 in mobile transactions value in August and October 2017, representing a shift toward digital channels.33 As of March 31, 2018, Axis Bank had 6.8 million mobile app users, a 72 percent increase for fiscal year 2018. It also had 3.7 million monthly users of FreeCharge, a digital payments company acquired by Axis Bank in 2017.34 Axis Bank reports it has reduced turnaround time on opening savings and current accounts by about 90 percent, and on other processes by 50-80 percent. It has also identified 90 other key processes within the company that could be re-architected using automation and AI.

The bank reports that it is leveraging emerging technologies including artificial intelligence, virtual reality, gamification, and machine learning.35 In 2016, Axis Bank launched the Thought Factory, an innovation lab for the development of cutting-edge solutions for the financial sector. The lab works closely with the start-up and fintech community on emerging technologies including blockchain, artificial intelligence, mobility, and cloud. According to Axis’s 2018 Sustainability Report, the lab is establishing an Artificial Intelligence Center of Excellence to building solutions that improve customer experience, personalize products, identify a customer base for pre-approved loans, and identify fraudulent transactions.36 The bank has launched instant international payment services using Ripple’s enterprise blockchain technology solution and cyber security program.37

7.7. Labor facts in India

7.7.1. Labor law

To understand the labor law implications of the automation-led impact on jobs in India, it is important to give context and clarify relevant terms:

The Industrial Disputes Act of 1947 is a critical piece of labor legislation that provides the machinery for resolving employer-employee conflicts in India. It also governs layoffs and retrenchment, striking, and conditions of service. The application of the Act is restricted to “workmen,” whose definition excludes “those employed in mainly managerial or administrative, supervisory capacity.”38 The courts generally interpret the definition purposively, based on the duties and powers conferred on the employee rather than just on the job title or designation.39

In this context, the terms “layoff” and “retrenchment” are distinct. Broadly speaking, layoffs mean the temporary dismissal of employees due to market conditions with the aim of rehiring the laid-off workers once business picks up;40 layoffs are usually accompanied by compensation41. Retrenchment refers to the permanent termination of employment, for reasons other than disciplinary action, and has a specified process and conditions.42

Unions play a key role in the Indian banking industry. The Indian Banks Association (IBA) enters into bipartite (two-party) settlements with unions to negotiate work conditions for workers, clerks, and sub-staff, and through joint notes for officers. The IBA had the mandate to do so from 43 banks (25 public sector banks, 11 private banks, and 7 foreign banks) when the tenth (and most recent) bipartite settlement was signed in 2015.43,44

Unions are stronger in public-sector banks than in their private-sector counterparts, such as Axis Bank, though staff from private-sector banks has participated in union activity at times. Trade union demands have generally centered around stricter enforcement of labor laws, policies regarding bad loans, and the consolidation of the banking sector.45

7.7.2. Labor trends in India

A number of additional articles shed light on current labor trends in India:

If you have any comments or questions, please feel free to Contact Us.